Have you completed your tasks to complete your 2021 tax return?

Posted on January 28, 2022

I used to be THE MOST DISORGANIZED, tardy person in gathering the information needed to complete our tax return. I procrastinated and was very late in filing returns. It eventually became an all-consuming, stressful task to file our returns. I’m probably over-organized and over-detailed now, but I really don’t mind spending time on cold, icy days in January on our tax return. I have a good checklist of all documents I need. Throughout January I schedule tasks in bite-sized chunks – maybe 25 minutes of time. By roughly this time of year, I’ve gathered and summarized almost everything for our taxes. The purpose of this post is to show you my checklists and schedule. You may find them helpful for your effort to complete your taxes.

I do a couple of things that make it easier for me.

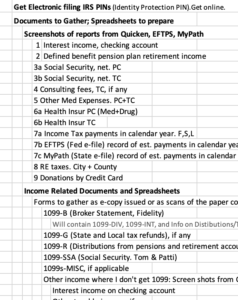

1) I use Quicken-starter as our checkbook. It costs $36 per year. I have a simple chart of accounts. I like to track certain expenses (How much do we spend on travel in a year?) and the ones that could affect our return. It’s easy to run transaction reports for each category of expense. I take screenshots and save them.

2) Our investment portfolio is in one place. That’s Fidelity for us. Fidelity posts when every tax document will be complete, so I don’t have any anxiety about when I will get them. I get can print all tax documents from the web site as .pdfs and save them. (They are also on the web site for seven years.)

3) I store everything on my desktop computer as PDF files: I have to scan some things, primarily letters of receipt for donations, but I get almost all other tax documents in an e- format that I print as a PDF file and save.

4) I have an accountant prepare our tax return. His fee was $675 last year. That’s for three tax returns (Fed, State, Local). That’s about double the cost of using turbotax for Fed and State, but I’m happy to pay the $675.

He gives me an organizer the first week of January that I have to fill out. That’s a good jog to make sure I get to work to complete the information I’ll need to give him. I like that my accountant prepares our return and I can check it. I would think at our ages our tax return would be really simple, but there always seems to be some wrinkle with our return that I think I would have missed. Something usually comes up during the year that I talk over with him at no added cost. I’ve filed amended returns in the past, and he’s completed those with no added cost.

I did one thing that makes completing our tax return a bit harder.

• In 2017 I invested in a new venture of two friends, based on our friendship and not the idea that I would make a lot of money. (I’ll eventually get back my investment, and that’s about all. That’s Okay.) That’s my only investment other than our index funds. I get a K-1, Partnership Return, sometime in March. That holds up my completion of the information for our accountant by about a month, and it seems there is always a wrinkle in the K-1 that I have not planned for. The investment ends in 2024. I’ll receive my last K-1 that year, and I’ll be happy when I don’t have to fiddle with that.

This past week I avoided thinking about the stock market. Here is what I did.

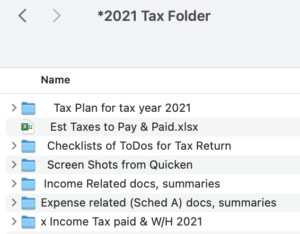

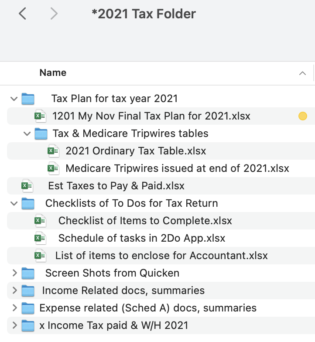

1. I simplified the e-file folders that I now have in two folders: “*2021 Tax Folder” and “*2022 Tax Folder”. These are the first or top two folders in my Documents folder. The folders in *2021 are almost filled, and the ones for *2022 are ready to populate next January. I show a screen shot of my *2021 Tax Return folders; I expanded two folders in the second display.

2. I listed all the items that I want to gather on the sheet, “Checklist of Items to Complete.” It looks like heckuva list for us that you can download here. It took me a lot more time this year to make this list than to gather the information!

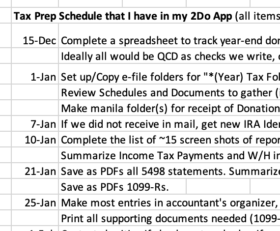

3. I sharpened my schedule of tasks that I enter in the 2Do App that I have on my desktop and my iPhone. That’s the sheet, “Schedule of tasks in 2Do App”. I think I have these a bite-sized pieces, maybe 25 minutes at a time, but I’m sure I spend at least an hour to go through the accountant’s organizer to make sure I’ve entered everything correctly, and then at least another 25 minutes to review before I give it to him in mid-March. This image indicates what the list looks like. You can see and print a .pdf of my list here.

I show the complete list of folders that I have in my *2021 Tax Folder here. The standard deduction for Patti and me is $27,800. That’s what applies to us. The accountant’s organizer askes for the detail for Schedule A, so I provide it. Other than the detail of donations, which really apply to our QCD, it’s just a few items.

Conclusion. I used to be EXTREMELY disorganized in gathering information for our tax returns. I procrastinated and was very late in filing returns. It eventually became an all-consuming, stressful task. I’m probably over-organized and over-detailed now. I actually like gathering the information in January so I have it all to give to our accountant well before April 15. This month I refined my lists of tasks and schedule. This post shows how I organize my e-file folders on my computer and my list of tasks in my 2Do App. You may find my organization helpful for your effort to complete your taxes.