Has your financial retirement plan anticipated the WORST?

Posted on February 19, 2021

Texas! Wow, what a mess! No heat, light, or water for millions. Did Texas plan for the WORST or is this just much worse than anyone could logically expect? I don’t know the answer, but I do know I feel really good about our financial retirement plan. Total failure in Texas was complete loss of power. To me that’s analogous to depleting our portfolio in our lifetime. We nest eggers should know: that cannot happen. We’ve planned properly to avoid that disaster. This post contains nothing new. All this is in Nest Egg Care, but the purpose of this post is to go down the checklist that runs through my head in times like this. I’ve gone down this list enough times that I can check them off in my sleep.

== TODAY is the start of the Most Horrible ==

Our plan is built on the assumption that TODAY is the start of the Most Horrible sequence of financial returns for stocks and bonds in history. That’s a sequence that contains a two-year period with 49% real decline real stocks. They dropped in half in 24 months! That sequence is 14 years with cumulative -10% real return for stocks. It’s twice as bad for bonds over those years. Oh, that’s miserable.

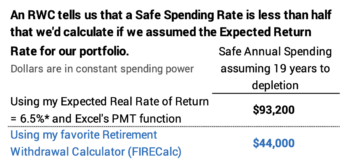

We calculate our Safe Spending Rate (SSR%; Chapter 2) using that Most Horrible sequence in our Retirement Withdrawal Calculator. Those horrible returns drop our spending amount to LESS THAN HALF had we assumed, for example, expected or normal returns. (The opposite of this: when returns aren’t horrible, we will calculate to much greater safe spending over time.)

== Steps to take when stocks go COLD ==

Our spending rate is already set to be at a safe level, but we nest eggers know we can act during retirement to futher protect our portfolio – extend the years for ZERO CHANCE of depleting our portfolio. I think of four levels of protection.

• I never forget to Rebalance back to my design mix of stocks vs. bonds at the end of each year. Bonds are a major form of insurance to protect our portfolio. When stocks return less than bonds in a year – that’s happened in about one-fourth the years since 1926 – we disproportionately sell bonds. That’s just how the math works out when we rebalance. We’re using some of our bond insurance to buy time for stocks to warm up and get back to their normal temperature.

When stocks get back to normal temperature – outperforming bonds in about three-fourths of the years – we’re disproportionately selling stocks for our spending and, in effect, buying more bond insurance. That makes sense: our portfolio is bigger and there is more we want to protect.

• When stocks turn DANGEROUS, RECORD COLD, we just pull out the stops and don’t sell any of them for our spending. Texas: go to your underground storage of diesel fuel and the small generators you have stored there; take the fuel and small generators to warm the bigger generators at the power plants that are not operating; fire them up to unfreeze the pipes and valves; and get the power plant back on line. Our Reserve (Chapter 7, NEC) – typically one year of spending – is like that underground diesel fuel and our store of small generators. We hope we never use that fuel, and it’s pretty much a dead cost – we don’t earn much on it. But is unbelievably valuable when it’s really bad.

• We all should have another deeper layer of Emergency Reserves, and that’s the unused balance of our HELOC. It would have to be an almost life-threatening event to use that for our spending, but we should gain comfort knowing that it is there if we need it. Patti and I have one year of spending available we could tap from our HELOC. My friend, Alice, has close to five!

• The final action is to spend just a little less. Spending less has a big impact on the safety of our portfolio. Lower spending stretches the years of ZERO CHANCE for depleting. Patti and I have built up a pretty big safety cushion that translates to being able to stretch the NO CHANCE years for us to well past age 100.

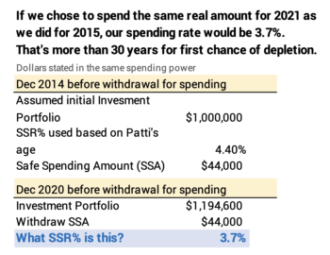

Good market returns have given us that safety cushion. We have 19% bigger Investment Portfolio – stated in constant spending power – in December 2020 than we had in December 2014 at the start of our plan. That’s despite increasing withdrawals for our annual Safe Spending Amount (SSA, Chapter 2, NEC). If we chose this past December to withdraw the same $44,000 of spending power we withdrew in December 2014, our withdrawal rate would be 3.7%. That SSR% equates to more than 30 years for the first chance to deplete. See Graph 2-4 and Appendix D, NEC. I’ve annotated on our most recent calculation sheet here.

Conclusion. The power outage in Texas reminds me how important it is that our financial retirement plan always has have the WORST case in mind. We nest eggers have a plan that assumes we will face the Most Horrible sequence of stock and bond returns in history – starting today. We make the right decisions at the start of our plan. We know the actions we can take during our retirement to further protect our portfolio. We should be very confident that we will NEVER deplete our portfolio during our lifetimes.