Are you ready for retirement? What do you spend on the Basics?

Posted on October 16, 2020

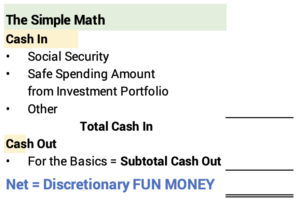

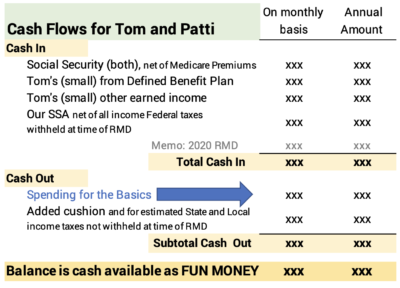

All we retirees – or soon-to-be retirees – have a burning question: Can our financial portfolio provide enough cash for spending for a Very Happy retirement – for the rest of our lives? You obviously need to add up the cash that rolls in every month: that’s basically Social Security + your Safe Spending Amount (SSA) from your investment portfolio [See Chapter 2, Nest Egg Care (NEC)]. You then need to know what you spend on the Basics, and, from subtraction, you know how much you have as Fun Money – the discretionary cash you can spend to ENJOY throughout your retirement. Nest Egg Care and this post answer the key questions on Cash Inflow each month. The purpose of this post is to provide a framework to answer the question, “How much cash do we need each month – or in the year – for what we consider as our Basic spending needs in retirement?”

I didn’t start my planning for retirement by estimating what we needed for our Basic spending. I was already retired. Patti was getting there. We were spending from our investment account when we needed to. Our portfolio wasn’t sinking, so I thought we were Okay. But I did not know where we stood with any confidence. That’s why I dove in to find our Safe Spending Amount (SSA), the amount we could pay ourselves from our financial portfolio throughout our retirement.

Our SSA, added to Social Security and some other income we have, was more was more than we were spending, and we weren’t skimping on travel at the time. I therefore knew we were better than Okay – that’s a nice position to be in – but I never went back and figured out what we spend for the Basics.

Patti asked last week, though, “What happens if you die? I’ll lose your Social Security (SS) check. You have a small monthly check from an ancient defined benefit plan; what happens to that? And you have some other income that I won’t get. Paint a picture for me: how much do we spend per month or year on what we might consider as the Basics, and how much discretionary income will I have above that?”

I could easily see what would happen to her monthly Cash In if I’m not around: the biggest impact is the loss of my SS check. But I had no monthly or annual number for the Basics. I could not tell her, “Here is the cushion – the Fun Money – you have each month that’s more than your spending on the Basics.” I had to first understand our spending for the Basics.

== The mechanics ==

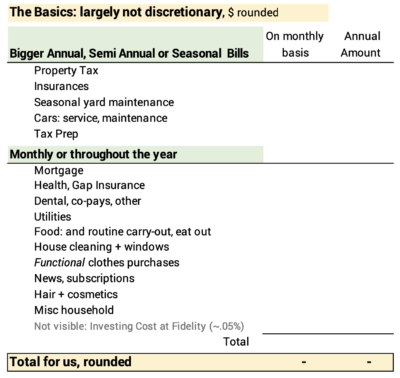

I used this spreadsheet to list all our Basic spending. The hard part was remembering the infrequently used vendors I should include. I kept adding more as I thought about them: Steven for the window washing; AJ for planting annual flowers; sporadic vet bills for Dudley over a year.

Once I had all the vendors or expenses listed, it was easy to get an accurate picture of the amount we spend in a month or year. My spreadsheet has a column for average monthly expenses and a column for total annual expenses. I either entered monthly expenses and multiplied by 12 or I entered annual expenses and divided by 12.

Monthly expenses that don’t change are easy to see on our credit card (The cable bill is charged to our credit card.) or as ACH debits on our bank statement (The cell phone bill is the prime example.) I have all our checks and ACH transactions in Quicken. I can easily get the total paid for the prior 12 months to all other vendors. I manually added up all food related expenses on our last three credit card statements to get a good picture of how much we spend on food per month.

== Our Basics are A LOT ==

What I consider as the Basics for us are A LOT MORE that I would have estimated off the top of my head. Our total is more than we spent we before retired. The big reason is that we have a bigger mortgage now; I took money from our non-financial asset – home equity – to get more money in our taxable investment account. That’s added cash I got with no tax cost. The second reason is that our home now is smaller but nicer and more expensive to maintain. I’m Okay with our Basics being more than I thought, since our Safe Spending Amount is well above our basics.

Four items add to almost two-thirds our total spending for the Basics.

• Mortgage P+I. We have a mortgage, and I include the Cash Out as part of our spending on the Basics. It’s by far our #1 use of cash. It’s Cash Out every month and we need Cash In every month to pay it. We basically get that monthly Cash In from our monthly pay out of our annual SSA.

But I don’t really consider our mortgage payment as a real cost. In essence, the dollars equal to the mortgage principal reside in our investment account. I view that Patti and I are going to earn roughly 6% real return per year – averaged over enough years – on that money. We pay roughly 1% real cost per year (3% interest less ~2% inflation). We’re five percentage points better off per year on the outstanding loan balance.

Looking at this differently, we could take cash from our investment account and pay off the mortgage to lower monthly spending on the Basics, but we choose not to.

• Food. I estimate we spend $550 per person per month. Everything we spend on food is on our credit card, and that was the average for the last three months. This is more than I thought. The total may be distorted some by the wildly high tips I leave for carry-out during this time of the Coronavirus. Those folks deserve our help.

• Property Taxes are high here. PA has about the tenth highest rate of property taxes in the US and Pittsburgh property taxes are well above the average in PA. Most of property taxes goes to schools, and spending per student for Pittsburgh public schools is among the highest in the US.

I hate paying property taxes. I’ve mentioned this before. Every year I consider just paying them with our HELOC, but I don’t. Paying them out of our SSA pains me: I keep thinking about the opportunity cost. What would we like better? Paying these taxes or being on a trip in Europe for two weeks? If we get in a pinch, or if Patti feels she is in a pinch when I am gone, I’ll use/she’ll use our HELOC for this outlay.

• Yard maintenance is a big expense for us. It’s WAY MORE than we used to spend before we moved about 13 years ago. I don’t think our yard as that big, but it takes a lot of care to keep it looking good. It generally looks fantastic. We could shave some cost, but we both want to keep our house and yard looking great. I think what we pay is on the order of what one might pay as a fee to a condo association, though, for annual upkeep of grounds and common areas.

I don’t budget for the cash that would be needed to replace our cars. That would be a big expense if I included it. We drive hardly drive our cars now. We both think it is silly to think of replacing them as part of the Basics. That spending will have to come out of our discretionary Fun Money. I’ll be reluctant to spend. I’ll think: do I want to spend this money on a new car or would I rather take two or three trips with Patti to Europe?

As I look over all these items, I conclude the two of us can’t reduce our Basics by more than a few percentage points.

== Patti alone would spend less ==

If I were not around, I calculate that the Basics for Patti would be about $1,000 per month less: food is the big expense saved; she’d sell my car and net enough to pay her car expenses for a decade. She lower Cash Out by a hefty amount if she chose to pay the property taxes with our HELOC.

Conclusion: At the start of your retirement – or just to be clearer if you are retired – you should have a good handle of how much cash you spend on a monthly and annual basis for the Basics. This post gives you a spreadsheet that I used. I found that our spending for the Basics is much more than I would have guessed without adding them up. But when I subtracted our spending on the Basics from our total monthly Cash Inflow, I still find Patti and I have enough discretionary Fun Money for the rest of our lives. That conclusion holds if only one of us is around.