What segments of US stocks outperformed in 2019?

Posted on January 10, 2020

I like looking at the Vanguard Style Box (I call it a Nine Box.) at the end of the year to get a snapshot of what outperformed and what underperformed the US stock market as a whole. US stocks are likely the biggest portion of your portfolio; they are more than twice the next biggest component – International stocks – in our portfolio. This post shows 2019 results. I previously reported 2017 and 2018 results.

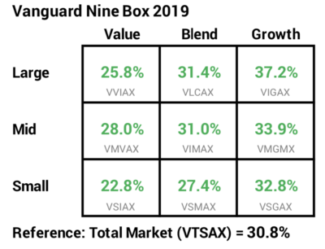

I display the Vanguard index funds that focus on each of the nine segments. (I have no idea why Vanguard’s list of funds on their Style Box excludes index funds this year.) I also display for reference the +30.8% return for VTSAX, the index funds that holds ~3,600 US stocks. (I hold FSKAX, a very similar fund to VTSAX = +30.9% in 2019. I would expect over time for the two to be virtually identical in return.)

Vanguard’s index funds track very closely to the underlying indices. Vanguard tracks performance of its index fund to indices constructed by a third party. It’s not the same company the Morningstar uses as benchmark indices, but for our purpose we should assume they are the same. Vanguard shows fund performance is very close to all its benchmark indices less the fund’s expense ratio, no greater than .07% for these funds.

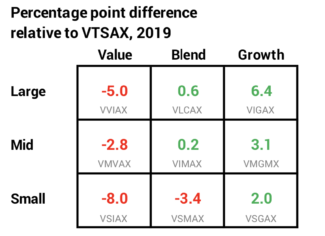

I display the percentage point difference from VTSAX in each box below. Five of the nine boxes were better than VTSAX and four were worse. Growth was the winner. Value was the loser. Large-Cap growth beat VTSAX by 6.4 percentage points, and it was also the clear winner in 2017 and 2018. Small-Cap Value was the worst at -8.0 percentage points. Large-Cap Growth Small-Cap value by 14.4 percentage points; that pattern has repeated for the last couple of years.

If you look at the Morningstar site, you will find that VTSAX is classified as “Large Blend” just like VLCAX. VLCAX (Large Blend) outperformed VTSAX because VLCAX is only large cap stocks – 592 stocks held. VTSAX hold holds the total market – 3,587 stocks – and was hurt this year by Small-Cap stocks.

== Five years ==

Common wisdom is that you can tilt your portfolio to outperform the average. The thinking is that Value will outperform Growth given enough years, and Small Cap will outperform Large or Mid Cap. (I put tilting toward small cap out of my head here.) Tilting these ways clearly did not pay off for the last five years. I know I can’t predict which box is going to outperform over the long, long time of our retirement plan. That’s why I hold Total Market funds.

For reference: Total World Stock Index, MSCI All Cap World Index = +28.11%. Total International Stocks (VTIAX) = +21.51%. (Patti and I own the ETF of this = VXUS = 21.75%.)

Conclusion: 2019 was a terrific year for US stocks. It was clearly the best since the start of our financial retirement plan five years ago. You can always expect some segments of the market to outperform and some to underperform. It’s been fairly consistent that Large-Cap Growth stocks have outperformed over the past five years. Value stocks, especially Small-Cap Value stocks have underperformed. I don’t think anyone knows what will outperform in the next five.