Should you skip taking your RMD this year?

Posted on April 3, 2020

Surprise – or at least it’s a surprise to me – the CARES Act gives us older retirees the option to skip RMD this year. This post addresses whether or not you should do that. My conclusion: most retirees have to take more than their RMD for their spending, so this has little effect. Those who don’t have to take more than RMD for their spending don’t gain much by not taking it.

== Meaningless for 80% of retirees? ==

The IRS reports that in a normal year 80% of retirees withdraw more than RMD from their retirement accounts. I’ll make the sweeping generalization that these folks do that because they need the cash proceeds for their spending. Otherwise they’d only take RMD and get the balance of their needs by selling taxable securities at lower tax cost.

This provision in the Act sounds good but isn’t any real help to this 80% of retirees, and these are the folks that actually need greatest help when stocks have tanked. These folks, like all of us, help themselves most by disproportionately selling bonds – now near their all-time high – to get the cash they want for spending.

== No big deal for the other 20% ==

Just 20% of retirees take only RMD. Patti and I fall in this group. We’re fortunate to have taxable financial assets. Our plan is to always take our annual Safe Spending Amount (SSA; see Chapter 2, Nest Egg Care). SSA is always greater than RMD. That means in a normal year 1) we sell securities in our retirement account for our spending; 2) we then get the balance from the lowest cost source of added cash – sale of taxable securities. (This may not be a normal year. Last week I described different steps I’ve taken for our RMD.)

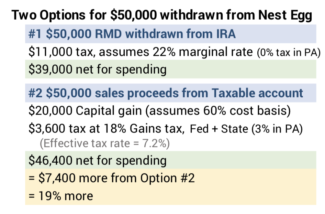

Patti and I could completely avoid RMD in 2020. We have the option of getting the cash we need for our spending by solely selling taxable securities. We’d lower our tax bill and keep about 20% more from our nest egg for spending. I’ve described this before, but here it is again. Here’s an example:

• Option #1: Assume our RMD is $50,000; we sell securities for RMD in December this year; 2) assume all of that would all be in the 22% marginal tax bracket. We’d incur $11,000 income tax on that $50,000. We’d net $39,000 after tax.

• Option #2: Skip RMD but sell $50,000 of securities from our taxable account in securities at about 7% effective tax rate or $3,600 tax. We’d net $46,400. That’s $7,400 or about 19% more after tax to spend in 2021 ($7,400/$39,000).

I’ve mentioned this in a previous post: that sounds terrific, but this is really a tax deferral. I’m not escaping paying $11,000 in tax on withdrawals from our IRAs. Selling taxable securities in 2020 gives us more to spend but I’m using up our low-tax source. We’ll wind up having to use our high-tax source – our retirement accounts – for our spending later. Even if we leave it to our heirs, they’ll pay tax, and I assume they’ll pay in the 22% marginal tax bracket.

That added $7,400 doesn’t have much meaning to me now. It certainly isn’t going to add to our FUN. Our biggest discretionary FUN expense is travel, and it looks like that is off the board until Patti and I are vaccinated.

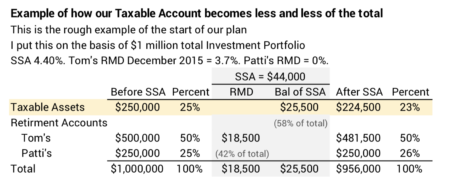

I am more concerned about the potential of paying higher taxes than I am about what little FUN I get from the added $7,400. I can see that high tax-day coming because Patti and I have proportionately less and less in our taxable account as the years roll by. That’s because each year we take out a greater proportion for our SSA from our taxable account. You see in this example that Taxable was 25% of the total before I withdrew our first SSA, and it was 23% of the total after I withdrew it. This pattern repeats year after year for us.

I have a minimum amount I want to always have in our taxable account. I can see that we’ll hit that point in a few years. That means I’ll have to take more than RMD from our retirement accounts. That would be very unappealing to me if I ever stumble across the amount of income that triggers higher Medicare Premiums – $2,000 a tripwire for the two of us – and a higher marginal tax rate that I (really Patti after I have died) could otherwise avoid.

Conclusion: The CARES Act lets us older retirees skip taking RMD in 2020. I don’t think this provision means that much to any of us. This really doesn’t help the 80% of folks who take more than RMD. They’ll have to withdraw from their IRA because they need that cash for spending. The 20% who can just take RMD will likely do that for 2020, too. All retirees will want to sell bonds to get cash for their spending. None of us want to sell deeply depressed stocks for that.