How much are you required to sell in your retirement accounts for your RMD?

Posted on March 27, 2020

You don’t HAVE to sell ANYTHING – stocks or bonds – in your Traditional retirement accounts when you take your RMD or any other withdrawal from your Traditional retirement accounts. These two decisions are separate: 1) How to take your RMD and 2) What securities you sell to get cash for your spending – including taxes. I bet most of us older retirees routinely sell securities in our Traditional retirement accounts to get cash, withhold taxes, and then transfer the net cash to our Taxable account for our spending: we think we must sell from our Traditional IRAs to get cash for spending. That’s not correct. This purpose of this post is to suggest a different way to think about how to take your RMD: transfer securities to your Taxable account and then decide what to sell to get cash for your spending.

== Option 1: Sell securities equal to RMD ==

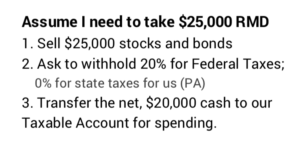

The usual way I’d guess all of us older retirees take our RMD leads us to the mistaken idea that we have to sell securities from our Traditional retirement accounts. Here’s the process for a normal year for Patti and me. Each of the last five years have been normal, and if I don’t think clearly it becomes the way I think I must use to take RMD.

• Based on returns for our performance year ending November 30, I calculate our Safe Spending Amount (SSA) for the upcoming calendar year. (See Chapter 2, Nest Egg Care and this post for our most recent calculation.) Our SSA will always be more than our RMD. RMD is a big portion of our total SSA, though.

• I take our RMD that next week, the first in December. I normally sell securities in our Traditional IRAs, withhold ~20% for taxes, and transfer the net amount of cash to our Taxable account. (Patti and I both have Traditional retirement accounts and are subject to RMD.)

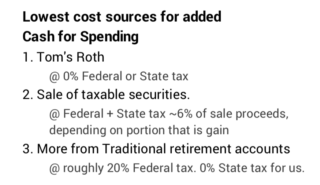

• I then figure out where to get the balance of our SSA. Arranged from lowest tax cost to highest, I can choose to 1) withdraw from my Roth (Patti doesn’t have a Roth), 2) sell taxable securities, or 3) take more from our Traditional IRAs.

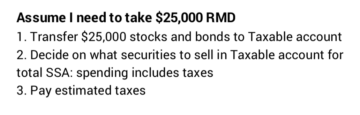

== Option 2: Transfer securities for your RMD. Then sell. ==

This year may not be a normal year. Let’s assume the following: stocks have cratered over the 12 months ending November 30; bonds have also declined. I decide that I don’t want to sell ANY stocks or bonds from our Traditional IRA in December. I want to give stocks and bonds a year to recover. I want to use cash from our Reserve in our taxable account for our spending. (See Chapter 7, NEC). (I described in this post that I now have enough cash in our taxable account to do that.)

How do I take our RMD? I transfer shares of securities from our Traditional IRAs to our Taxable account. I’ve sold nothing: in my case I can use Fidelity’s web site to transfer a dollar amount of securities to our taxable account and withhold nothing for taxes. Fidelity calculates the shares that fulfill the dollar transfer I request based on the end-of-day price. Overnight those shares disappear from our IRA accounts and appear in our taxable account.

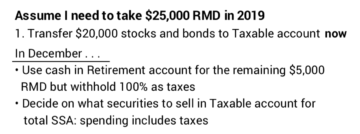

== Took most of our 2019 RMD now ==

Two weeks ago I took most – about 80% – of our 2019 RMD by transferring securities from our Traditional IRA accounts. I would usually do this the first week of December. Why would I do this now?

• I want lower RMD over time. I want less in Traditional IRA. Stocks were down. At lower price/share, I am transferring a bigger portion of shares for my total dollars of RMD.

• I want more dollars in my Taxable account. I want more of a lower tax-cost source of cash for spending. I want to delay or perhaps totally avoid having to withdraw more than RMD from our Traditional retirement for spending, since those withdrawals have the highest tax cost.

I left some – about 20% – RMD that I have to take in December. I know I should withhold ~20% of total RMD for taxes. I could pay estimated taxes now on RMD; I’d use EFTPS to make that simple. But I’d rather withhold those taxes on that final slice of RMD I will take in December. I have cash now in our Traditional accounts to do that. That means that final withdrawal will be nearly 100% taxes withheld.

Conclusion. Don’t go on autopilot and think that you are forced to sell securities from your Traditional retirement account for your RMD. Think of these steps first:

1. Take your RMD by transferring securities from your Traditional IRA accounts to your taxable accounts

2. Then figure out what you have to sell for your gross spending, which includes estimated taxes.

In a normal year, this will strike you as unnecessary. You’ll decide just sell securities in your retirement accounts, withhold taxes, and then transfer the balance. But don’t make this the default thought process every year: don’t automatically think you have to sell securities from your retirement accounts for your RMD.