Is this the time to improve your financial insurance?

Posted on March 6, 2020

Wow, this is a crazy time. Last week I described how I could wait nearly four years before I would have to sell stocks for our spending. I could sell our insurance against painful declines in stocks – selling bonds only for our spending – up to the end of 2023 and maybe into 2024. This post is a brief explanation of how I improved the quality of our insurance today: I removed a part of the variability in the value of our insurance. I effectively pre-sold bonds equal to our spending in 2021. I now have the next 22 months of spending in cash.

== Bonds are insurance ==

We own bonds to sell them, not stocks when they have cratered. When it’s too painful to sell stock, we’ll disproportionately sell bonds or solely sell bonds for our spending. Bonds are insurance. That’s it. We don’t own bonds to smooth out the annual variations is our portfolio – that’s what most people think.

== We have enough insurance ==

The recap of last week’s post is that Patti and I can wait nearly four years before we HAVE to sell stocks. That’s plenty of insurance in my mind. We don’t need more. We don’t need to sell stocks now to get more bonds:

• We have the balance of our pay for 2020 – our annual Safe Spending Amount (SSA) – in cash and CDs that mature later this year. I got that cash from the sale of primarily stocks last December.

• We have about two years of spending in Reserve. Our Reserve is the off-the-top amount I don’t even consider as part of our Investment Portfolio. I keep that in an intermediate bond fund, IUSB. If I decided to use those two years – totally avoiding selling anything from our Investment Portfolio – I could cover spending in 2021 and 2022. I’d first have to wrestle with the possibility of having to sell stocks in December 2022 for spending in 2023.

• We can lower our monthly spending over the next two+ years and slide that date out another six months to July 2023. And if I pulled out the stops I could slide further to December 2023 or even early 2024.

== Insurance quantity is near an all time high ==

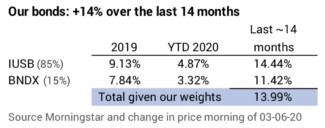

The quantity of our insurance is much more than it’s been. We all have more insurance if you follow anything close to IUSB and BNDX. Both IUSB and BNDX have been on a tear over the last 14 months. I have 14% more than I did at the end of 2018.

Why this tear? Bond prices move in the opposite direction to the change of interest rates. Interest rates have fallen to record lows. The return on a 10-year US Treasury note is below 1%. It’s really getting hard for me to think that rates can get lower and bond prices higher. This morning, however, IUSB is up another .74%.

== The quality of our insurance ==

All our bond insurance is in intermediate bond funds – 85% is IUSB (Total US bonds) and 15% is BNDX (Total International bonds). I’m not driven to make more money from bonds, I just want them there to sell for spending when if (when!) stocks tank. In normal times, I’ve very happy with these two.

== A good farmer pre-sells part of his crop ==

My gut tells me I should be like a good farmer. A good farmer wants to avoid the variations in price that he may receive for his crop that he harvests, stores, and finally sells each December. Spot prices can swing widely depending on crop yields and demand. In the past 15 years, the spot price for corn has ranged from $1.90 per bushel to $8.00 per bushel. The smart farmer takes the some of the risk out of the price he will receive by contracting to deliver part of his crop in December at a set price. He enters into a futures contract.

The spot price today for corn is $3.82 per bushel. That’s about the average over the last five years. A farmer can contract today to sell a part of his corn crop at $3.85 per bushel. He looks at that and decides he’d be happy with that price. He knows the spot price then may be higher or lower, but that’s not the issue: he’s taken some risk out of the total revenues he will receive for his 2020 crop – revenues he’ll need for his family and for the business in 2021.

== I forward sold money I’ll need for 2021 ==

In essence, I did what the farmer does. I forward sold the crop that I would likely harvest for our spending needs in 2021. Well, I really didn’t enter into a forward contract: I just sold enough IUSB to equal our 2021 spending needs. I’ve taken out any variability that may hit IUSB between now and then. I’ve improved the quality of our bond insurance: I’ve locked in a good price of part of that total crop. I now have the 12 months of 2021 in cash. That’s in addition to the 10 months remaining in 2020 that was already in cash. The next 22 months in cash.

That doesn’t mean I won’t sell stocks and bonds in December for our spending in 2021. Nine months is a long time from now. But if stock returns tank relative to where they were on November 30 – the last day of our calculation year – I have locked in the value of a big part of my insurance at a price I’m happy with now. I have improved the quality of our insurance.

Conclusion: Bonds are our insurance against very poor stock performance. We retirees must annually sell securities for our spending needs. We sell more bonds or even solely bonds when stocks tank. I’ve kept all our bonds in our Reserve and Investment Portfolio in intermediate bond funds. Over the last five years, the amount of our insurance has increased – especially over the last 14 months. With this bad turn in the variability of stocks, the time may come later this year when I’ll have to use our bond insurance. I’m happy with the price of our bonds now. I effectively locked in the price will get this next December. I simply sold part of our intermediate bonds.