Category Archives: Uncategorized

Is Equal Weighting a means to easily beat the market?

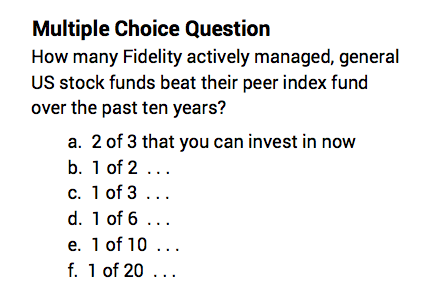

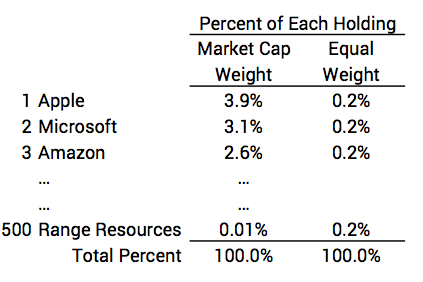

Well, this article says it’s a slam-dunk. Investment Strategies To Improve on Passive US Indexing states Equal Weighting is the way to go for retirees. The purpose of this post is to discuss the article and give you evidence from performance of several Equal Weight

We Nest Eggers keep 98% of what the market gives all investors.

It’s a key part of the Nest Egger Way: Nest Eggers invest to be at least in the top seven percent of all investors. We invest to simply and efficiently keep 98% of what the market in aggregate gives all investors. We don’t try

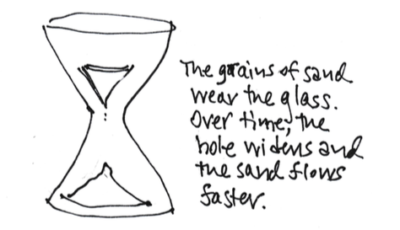

I shudder at the institutional default of 60% stocks and 40% bonds.

A prior post discussed the insurance value of bonds. When stocks tank, bond returns are always better and almost always MUCH BETTER – as much as 63 percentage points better in a year. Since we retirees are selling securities each year for our spending, we