Category Archives: Uncategorized

My Rant: It’s unfair. We retirees are victims of not knowing.

I discuss Why I Wrote This Book in Chapter 1 of Nest Egg Care and also here. Both of those reflect “the nice” me. As time goes by and the more I think about it, the more frustrated and cynical I get. The “angrier

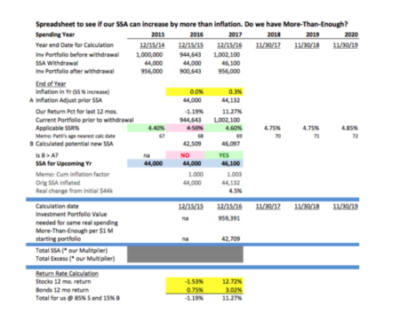

My 4.5% Pay Raise Calculation, December 2016

You can see the calculations on this spreadsheet. I first entered the return rates for the prior 12 months for our stocks and for our bonds. (You can see at the top of the sheet that I used December 15 as the end of