Category Archives: Uncategorized

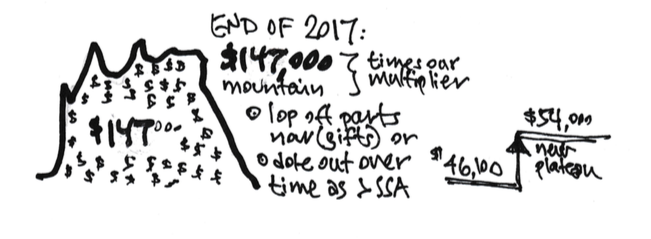

Tell me again: why do Patti and Tom have this mountain of cash that is More-Than-Enough for current spending?

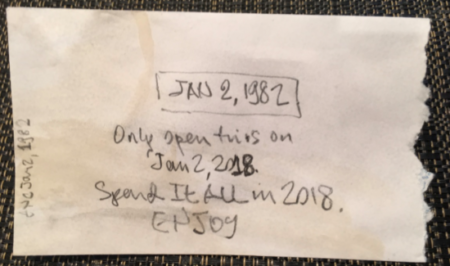

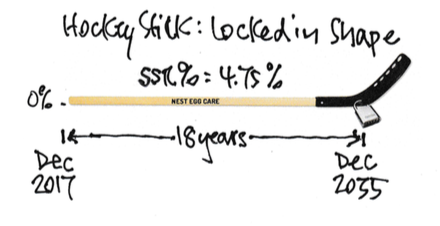

In our Recalculation the first week of December, Patti and I found that we had far more than enough to support our current spending. A small mountain of cash: +$147,000 per $1 Million starting Investment Portfolio (December 2014). And a calculation of a new Safe

A perfect gift idea for your loved ones: start 529 College Savings Plans

This is the time of year that we all think about giving to others we care about. If you’re like Patti and me, you have some left over from your 2017 Safe Spending Amount. Or, if you’ve recalculated for next year (following the CORE),

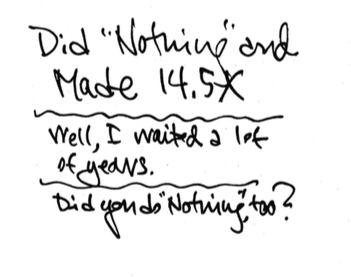

Anticipation: my recalculation date is less than 3 weeks away

I peaked. The R in the CORE is coming up for me: Recalculation. Oh, boy. Wow. Unless the world falls apart over the next three weeks Patti and I have dodged the bullet of “bad variability” of returns for three years now. It’s waaay