I discuss Why I Wrote This Book in Chapter 1 of Nest Egg Care and also here. Both of those reflect “the nice” me. As time goes by and the more I think about it, the more frustrated and cynical I get. The “angrier me” rants. I’m not quite at the point of, “I’m mad as hell, and I’m not going to take it anymore!” But I might get there.

It bugs me that so few retirees truly understand What Is Safe to Spend and How To Invest (or even get close). I contend that it isn’t hard to get to answers to these questions. You can make clear, evidenced-based decisions in your Nest Egg Care workbook. Your decisions may be a bit different than mine, but the data and evidence are there for us all to use. I may have laid out the evidence more clearly than most. (You can visualize that you are picking a hockey stick to fit ‘just so’ under your playground slide.) But getting to the answers is pretty straightforward in my view.

The fact that most all retirees don’t get to those answers borders on being unfair. The financial industry, with rare exception, keeps retirees off balance or in the dark. When I ask financial advisors for the key decisions for a financial retirement plan and the priorities of those decisions to be super safe, they NEVER HAVE listed the same decisions and in the order that Nest Egg Care lays out as important. This is CRAZY in my opinion. (Maybe they think I am crazy!) It shouldn’t be this way.

We’re all victims of not knowing. We rely on intuiton for our plan, not evidence. Our intuitive plan is the obvious one that makes sense: we spend little; we may even fret over the smallest expenditures; we invest with the view of minimizing annual variability in our portfolio; we hope that what will be there for our heirs at the end will be “enough”. While this is Okay, it is far from what retirement could be if we really spend time thinking about and implementing a plan. I contend the plan you will develop using the worksheet in Nest Egg Care will be safer than the one you are following now and leads to more for you to spend (and gift) to enjoy and for your heirs.

Why doesn’t anyone paint a picture of a realistic future; why do we focus so much on doom and gloom? Of course, we always plan for the worst, but the its much more realistic to expect that we’ll have much more to spend (or gift) in the future. Why doesn’t someone tell you (shout at you): if you are on an average track of financial returns, you can expect to spend MUCH more than your initial Safe Spending Amount? Or, “You’re clearly past the gauntlet of initial poor returns that can deplete your portfolio. You’re on a whole new track. You can Spend More to Enjoy More. So get to it.” None of the retirees I know have anyone telling them that, and some are paying a lot to someone who should be telling them that.

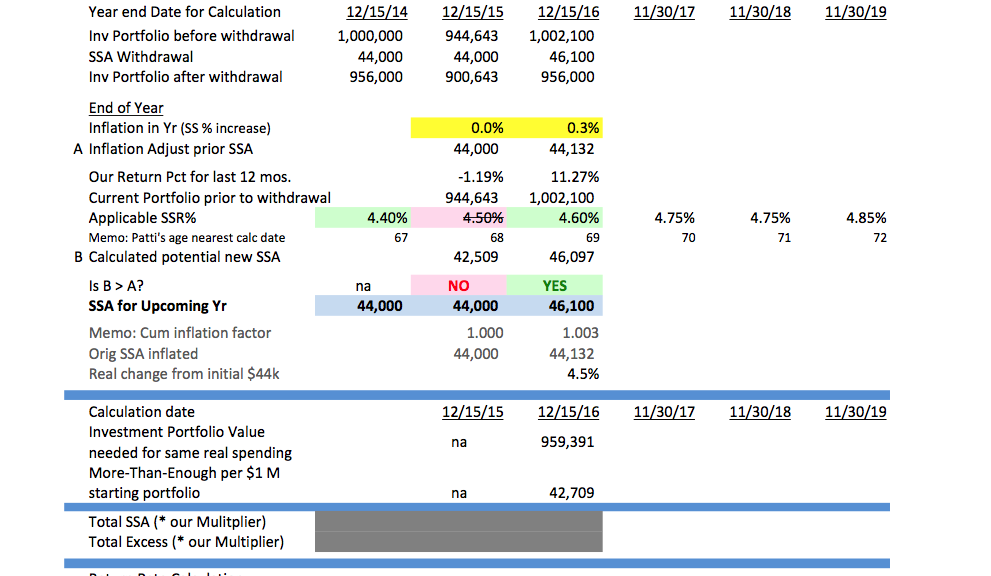

This should have made the headlines at end of 2016: ALL retirees – especially those under age 70 – following the CORE principles “earned” a real pay increase for spending in 2017. How many retirees knew that? Why did no one tell them that?

Almost all retirees I talk to have NO written financial retirement plan – or just a statement of a plan that they can simply summarize for me. This makes NO SENSE TO ME, particularly for the folks paying perhaps $10,000s PER YEAR to advisors. It’s just not that hard to develop and document a plan. Ours fits on a 3” by 5” card. I think I can summarize it in less than one minute. The plan is darn simple, and a sound investment portfolio for the future is shockingly simple.

It bothers me: most all retirees are spending money needlessly incurring far too high of Investing Cost that 1) lowers their Safe Spending Amount that they can spend to enjoy; 2) that increases their risk of depleting their portfolio in the out years; and 3) that also lowers their potential portfolio value in the future. Retirees are needlessly LOSING THREE WAYS.

Let’s all get off the slow moving boat that’s headed in the wrong direction. Develop your own financial retirement plan by understanding and following the CORE principles in Nest Egg Care.