Is Equal Weighting a means to easily beat the market?

Posted on April 13, 2018

Well, this article says it’s a slam-dunk. Investment Strategies To Improve on Passive US Indexing states Equal Weighting is the way to go for retirees. The purpose of this post is to discuss the article and give you evidence from performance of several Equal Weight ETFs you could choose. Here’s my conclusion: I don’t see the evidence says that Equal Weight, a method to overweight smaller company stocks, pays off. That’s similar to what I stated here.

(I do agree with the article about ”Going International” [see Chapter 11, Nest Egg Care]. I’ll discuss the other Strategy mentioned in the article, Value and Momentum Weighting in another post, but I think my conclusion on that will be the same as for Equal Weight: you can Tilt ‘til You Wilt, as I state in Nest Egg Care, but I don’t see that its really worth the added cost, effort and, perhaps, the added complexity to your portfolio.)

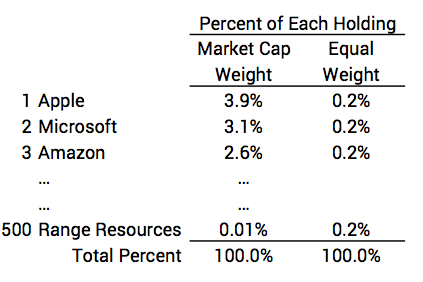

What is Equal Weighting vs. Market Capitalization Value Weighting? You hold the same percentage of each stock with Equal Weight. Weight by Capitalization Value holds stocks in proportion to their total market capitalization value (total number of shares times price) relative to the total value of all stocks in the portfolio. I’ll assume you understand the difference in the two methods from the image at the top of this post. You can read a longer description at the bottom of this post.*

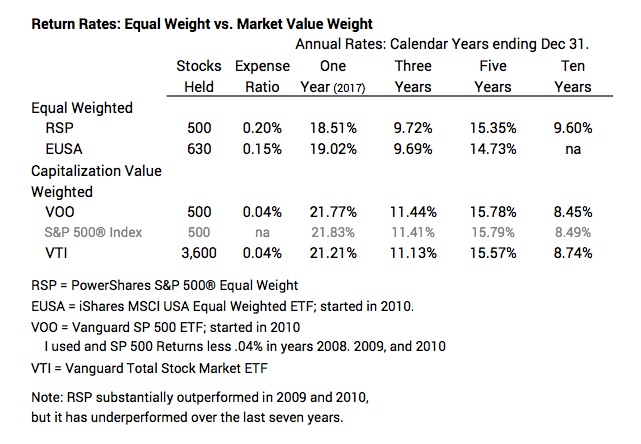

The article cites a 2012 academic study that states that over four decades Equal Weighting a portfolio improves returns by “1% to 2%” (that’s really meant to say one to two percentage points per year) over the conventional weighting by Capitalization Value. The author of the article recommends a low cost ETF, iShares MSCI USA Equal Weighted ETF (ticker: EUSA) with an expense ratio of .15% versus .04% for a typical Capitalization Weighted EFT. So, for about .1% in added cost, you get one to two percentage points greater annual return. It’s an obvious choice. If it really works.

So, I read the 37 page study. Wow, was that a lot of detail. If you read it, you’ll come across terms like these: nonparametric monotonicity relation test; kurtosis; power utility investor; log-utility investor; negative skewness; reversal factor; idiosyncratic volatility; systematic return, certainty equivalent return; Sortino Ratio; Treynor Ratio.

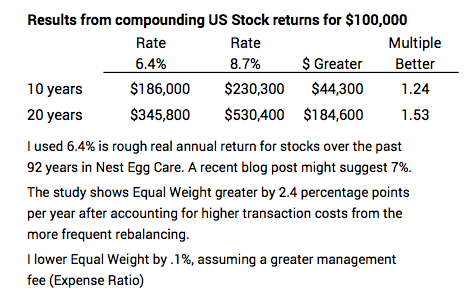

Results are based on the average results of many 1000s of portfolios each comprised of a sample of stocks (e.g., 100) from the S&P 500® (largest 500 companies in market capitalization value) and similar samples from other indices (e.g., Small Cap S&P 600 index). The process rebalanced each Equal Weighted portfolio monthly. Monthly rebalancing was essential; advantages of Equal Weight dissipated with less frequent rebalancing. If the rebalancing was once per year, for example, Equal Weighting resulted in NO improved performance. But following the monthly rebalancing process in the article, Equal Weight outperformed Capitalization Value weight by 2.4 percentage points per year and outperformed in 2/3 of years.

That’s a Big Deal, as you can see below. I’ve show this as 2.3 percentage points better after assuming a .1% greater expense ratio (basically management fee). That’s beating the market by about 35% per year (2.3 points better/6.4 percentage points for the long run real return rate). You’d accumulate about 25% more in a decade and 50% more in 20 years. Oh, man, you can see that it’s a lot of moola. We Nest Eggers gotta invest this way if this is true.

How has this worked in practice? That increase in performance is so significant, I’d think we should easily see the benefit over a fairly short history. We can simply compare the results of low cost ETFs that emply Equal Weight to see how it has worked. You can see here the results I assemble from compounded returns over the last decade. My conclusion: Not Great.

I was expecting to see better results almost every year and at least a point or two better every year. But over one, three and five years, Equal Weight does not match Capitalization Value Weight: Equal Weight trails by perhaps one percentage point per year for results over the past five years. (Note that RSP did outperform in 2009 and 2010, so over 10 years, it is better by about one percentage point.)

What’s going on here? Why isn’t Equal Weight consistently delivering better returns that approach 2.4 percentage points per year? I dunno. It seems we find a result in this study and then search like hell to find a reason why it is true. The authors did not start with a logical hypothesis as to why Equal Weight should be true and then work to see if the evidence supports that hypothesis. That’s how I view the scientific approach, the correct way to get to a solid conclusion.

I don’t see a logical reason to think that smaller capitalization stocks will outperform and by that much. I don’t see a logical reason why monthly variability of returns combined with frequent rebalancing would lead an equal weight portfolio to outperform and by that much. (The logical extension from the conclusions from the study would be to rebalance an Equal Weight portfolio weekly or even daily for even greater advantage.)

But it’s a good story, and we all like stories that tell us we can beat the market. That’s the powerful lure. The story may appeal to you. It does not for me. It looks to me that Equal Weight results in lower performance and more unpredictable returns than what the market gives all investors in aggregate – measured by total increase in the market capitalization value of all stocks. We Nest Eggers hate doing something that results in greater uncertainty and less predictability. We just want to consistently keep 98% of what the market in aggregate gives all investors.

Conclusion: Some recommend retirees invest in an ETF or fund that employs Equal Weighting as a way to significantly boost returns. It’s a way to overweight smaller company stocks. A detailed academic study supports this strategy. The results from low cost ETFs that implement Equal Weight do not: returns from Equal Weight for the last five years lag conventional, low cost index funds that use Capitalization Weight by perhaps one percentage point per year. I conclude that it’s best to just stick with the predicable result of keeping what 98% of the market gives all investors (Capitalization Weighted).

*Equal Weighting means you own a fund or ETF that holds an equal percentage of each company in its portfolio. If you owned a fund that equal weighted the all the holdings of the S&P 500, your value for each holding would be 1/500th of the total. You’d own 1/500th of Apple (.2%), 1/500th of Microsoft (.2%), all the way down to Range Resources (.2%).

The S&P 500® index is by Capitalization Value. A daily (monthly, yearly) change in the value of the S&P 500 is the change in the total market capitalization value of all 500 stocks (including the effect of dividends). That means the percentage change in the value of Apple (about 3.9% of the total value of all 500 stocks) is weighted more than 500 times than the percentage change in value of Range Resources, which has a market capitalization value that is .013% of the total of all 500.

Therefore, Equal Weighting is another way of overweighting smaller company stocks. Relative to Capitalization Value weighting, Equal weighting would slash our holding of Apple by a factor of about 20 and boost our holding of Range Resources by a factor of 15.