How much lower will your taxes be in 2018?

Posted on May 18, 2018

I visited my accountant, Bob, this week to finalize my 2017 taxes. Yep, I was little late completing them, but he finalized the returns and filed them this week. When we sat down, he gave me some information for my tax planning for 2018. I’m clearly not a tax expert, and you should rely on your pro. But I’m passing on what I learned in this post.

I conclude we can expect roughly 15% lower Federal taxes in 2018 for the same Taxable Income as 2017. Taxable income is basically line 43 of your 1040. That’s your Adjusted Gross Income (line 38) less Itemized Deductions (line 40).

[Note: Your Taxable Income may not be calculated the exact same way in 2018 as in 2017. The change I’ve heard about most is the limit on Itemized Deductions.

Deductions for state and local income and property taxes are limited in 2018 to a total of $10,000. That has little effect on Patti and me, since state (PA) and local (Pittsburgh) taxes on retirees are low. Neither tax Social Security or retirement income: they taxed it when we earned it; they gave us no deduction for contributing to our retirement accounts. Also, we can avoid Pennsylvania taxes on any other income if we choose to. Therefore, our calculation of taxable income in 2018 will be very similar to the way we calculated it in 2017.]

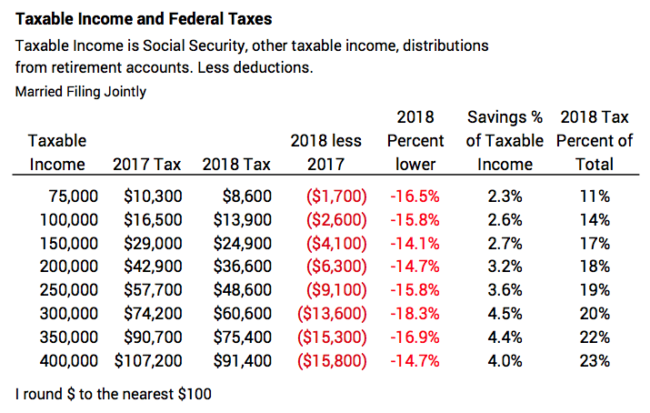

I show the detail of the tax bracket changes here. I summarize the effect on Taxable Income in the table below. You can see that this works out to be about a 15% or more cut in Federal taxes for a wide range of incomes. That translates to 3% or so increase of Taxable Income that’s in our pockets – more fun money for us.

I display incomes up to perhaps ridiculously high amounts, partly to see how the percentage tax reduction affects higher incomes. [But older retirees could have high incomes, because their calculation of their Safe Spending Amount will be much higher: their Safe Spending Rate (SSR%) is much greater, and with recent market returns, all of us have a bigger investment portfolio – even after high withdrawals for spending.]

I’m also clearer on the total percentage tax I will pay. I used too low of withholding rate in 2017 for our estimated quarterly payments and for withholding when I took my withdrawal from my retirement accounts. I’ll adjust to 20% to make sure I’m covered.

Conclusions. My rough picture of the impact of new tax rates means we’ll all see about 15% or so lower Federal taxes. The increase in our take home pay is a meaningful amount. We can all have more fun. Or give more to those we care about.

We all should use 20% (or close to 20%) for quarterly estimated taxes on Social Security and other income and withholding on withdrawals from our retirement accounts.