You have more money now than you did three years ago. What’s that mean?

Posted on April 6, 2018

I’ve asked that question to a number of retired folks. I was a bit surprised with the answers. Most retirees had not given a thought as to what that means other than the obvious: the market has been good to them. Maybe too good in their view: “What goes up comes down.” That’s a lot of cumulative up in the last three years – US stocks are up +33%! (And up more than 115% over six.) How would you answer that question? If you have a financial advisor, what is he or she telling you? Nothing, I bet.

All retirees should give a very similar answer to that question. My friend Karl instantly gave me what I think is close to the right answer, “I’ve not been spending enough.” (Karl told me that he and his wife years ago decided on the amount that should go to his three children and they gifted [directly or perhaps in a Trust] to them. So, what Karl has now is for his spending and for his favorite charities.)

I would answer that question slightly differently, because I know Patti and I have been spending enough. We know our annual Safe Spending Amount (SSA): we follow the CORE. We’ve paid ourselves our annual SSA. We know spending more than that amount borders on unsafe. And spending less than that amount makes little sense to us. We’ve spent it (or gifted it) ALL each year. Nothing was left at the end of a year to throw back into the pot. Therefore, we didn’t spend (and gift) too little.

The correct answer for us is, “We’re paying ourselves such that we shouldn’t really be accumulating more, but we do have more. That means we definitely have more than needed for our current spending. We should spend (and/or gift) more in the future. Let’s start on that right now.”

That conclusion comes from two facts, also stated here:

1) As we age, we need less portfolio value to support a given level of spending: our money doesn’t need to last as many years. When I am 80, Patti and I will need 35% less portfolio value for the same real spending level than when I was 70.

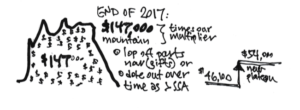

2. When our portfolio value increases to more than it was in the past (after adjusting for inflation), it’s obvious that we have accumulated More-Than-Enough for our current spending. Our withdrawal rate at the end of 2016 was less than 5% for our 2017 spending. But with the high stock returns in 2017 (+20%) we obviously had more at the end of 2017 than before that withdrawal.

Combining effect # 1 and #2, Patti and I calculated, base on our one-year returns on November 30, that we had accumulated a fairly large mountain of More-Than-Enough. You also accumulated More-Than-Enough, but unless you did the calculation you don’t know how much More-Than-Enough.

We’re now paying ourselves about 15% more in 2018 than we did in 2017. What are the potential actions running through our minds now?

Spending:

What’s going to be more fun for us? What added or better trips (better travel, better lodging, longer stay) might we want to take? We have a safari to Africa on our punchlist. Should we do that in 2018 or 2019? Might we take a trip somewhere south soon where it’s warmer than Pittsburgh?

Giving:

How much should we give to our heirs/family now and in what form? We like gifts to 529 plans for a number of reasons. We like gifts to their IRAs – we’d like all family members to have an IRA that they contribute to, and maybe our gift can be an incentive for them to contribute more. Both these gifts will improve their lives down the road. Maybe Big Time.

Do we have siblings or others who could live a much happier life or have a life experience that they’ve been wanting to do? Might we help pay for a dream vacation? Needed home improvements?

We have a favorite four charities. Should we step up our giving to a higher level?

Conclusion. Retirees’ portfolio value, adjusted of inflation, has increased over at least the last three years if they are spending and investing at anything close to the plan they’d develop in Nest Egg Care. That means they have More-Than-Enough for their current level of spending. They can spend at a much greater level and/or they can give much more now and appreciate now the impact of their giving.