Now that you’re retired, is Investing Cost your top monthly expense?

Posted on May 4, 2018

Oh, I hope not. If you are a Nest Egger, the answer clearly is NO. If you are not a Next Egger, you may find that that your Investing Cost is your top monthly expense. It is for a couple of friends of mine.

This drives me batty: too few people calculate their Investing Cost. Too few people realize that they control and must decide on their Investing Cost as part of their financial retirement plan. It’s the second most important decision they will make. The purpose of this post is to urge you to calculate your Investing Cost. See how it ranks in terms of your routine monthly spending. And then decide to cut it. To the bone. You’ll find a description on how to calculate your Investing Cost in Appendix F of Nest Egg Care. And you’ll find a spreadsheet that helps under the RESOURCES Tab on this web site. (Here it is directly.)

Here are two examples:

• My friend Mary spent all of February with her daughter and family in Seattle. Nice. Enjoy Now and spend more time with your family. When she got back, she mentioned at the weekly coffee klatch (We call ourselves the Council of Elders.) that she spent $1,000 to keep her dog in the kennel for the month. I said, “Yep, that’s what it’s going to cost. You put her in the #1 kennel in the whole area. You know she was well cared for and really had a good time.”

At the gathering of elders a week or two later, she mentioned again that she spent $1,000 to put her dog in a kennel for a month. She’d forgotten that she told us this before. This obviously was bugging her. I warned her that I was going to make a snide remark: “During that month, you paid $2,000 to your investment advisor and fund managers for your investment portfolio. And now it’s a month or so that you’ve been back, and you spent another $2,000. You spend that $2,000 each month. That’s more than your mortgage payment. That’s more than your property taxes. That’s more than all your utilities. It’s more than all of that combined. What gives with that?”

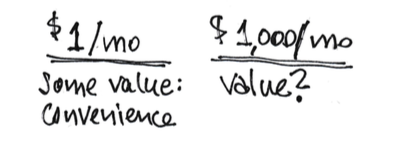

• Patti and I had coffee with our friends John and Jill a couple of weeks ago. Jill mentioned that she was not happy that her iPhone did not store all the photos she has – probably more than ten years worth. Patti said, “It’s $1 per month to get more storage in iCloud than you will ever need.” Jill said, ”I don’t want to pay that. It’s not nearly as convenient for me, but I can store my photos elsewhere and save the $1 per month.”

I said nothing, but over the next week or so that $1 per month rattled in my head. I thought about it every day. I’d guess that John and Jill spend $1,000 per month in Investing Cost to their financial advisor + fund managers for their Nest Egg. It has to be their top routine monthly expense. And that $1,000 is mostly just a dead expense: it’s very improbable that better than average performance by fund managers can cut the net effect of those costs. (That would also be easy to check.) How in the world can $1 per month (that gives some convenience and therefore is of value) be of concern when $1,000 per month (at near-zero value) isn’t of concern?

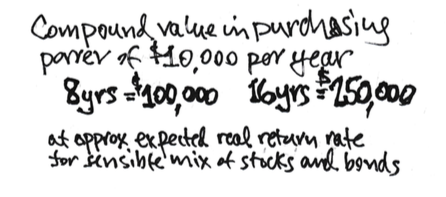

On the same basis, I’d estimate that Patti and I spend $60 per month.(That $60 per month is at the very bottom of our routine expenses.) We spend about 1/15th and $940 less per month than John and Jill. That means we spend $10,000 less per year in Investing Cost. That’s A LOT more Enjoyment for us Now. That’s A LOT more that we can give now to heirs. If we (or our heirs) just leave it for the future, that $10,000 per year will most likely compound to $100,000 in today’s purchasing power in about eight years. More over more years.

Why don’t folks know their Investing Costs? Well, first, the financial industry doesn’t make it easy to calculate your total costs, and, second, they are obscured in the way you pay them. Those financial guys are really smart in this regard.

It’s not easy to understand your costs. A big part of the total you are spending is the Expense Ratio (basically administrative, marketing and fund manager fees) of each mutual fund or ETF that you own. You’ll never see these stated on your monthly or annual statements. They’re a cost that’s subtracted from the gross return earned by a mutual fund,* so you don’t see them directly. You have to go to an independent source like Morningstar to find the Expense Ratio of each mutual fund or ETF that you own, do a little multiplication to get your dollar cost for each, and then add them up. (See spreadsheet.)

The other expense you may incur, that of a financial advisor, is obscured among the list of transactions of dividends, interest, and gains distributions received in a monthly statement. That’s the detail that almost no one ever looks at. Almost all folks I talk to who employ a financial advisor cannot tell me what they spend.

The method of collecting fees from you obscures them. The financial guys know it’s far better to subtract expenses and fees from your Nest Egg so that you really don’t explicitly see them. The last thing they would want to do is to actually send a bill for those costs. They know: do not do business like the kennel (or any other routine service you receive). NEVER send a bill.

Mary picked up her dog. She was handed a bill for $1,000. She presented her credit card and authorized the $1,000 payment. Later she saw the $1,000 on her monthly statement, and then she thought about it one more time as she wrote the check to pay her total credit card bill. Jill would have seen that $1/month on her credit card statement perhaps for as long as she owned her iPhone. But neither clearly sees one dime of expense or writes a check for the over $1,000/month they pay in Investing Cost: out of sight; out of mind.

Don’t be like most folks. Do not ignore Investing Cost. Calculate it. Figure out how it ranks among your routine monthly expenditures. Also do the experiment on the performance of your stocks and bonds that I think will convince you that you gain nothing from high Investing Cost.

Conclusion. You decide on the Investing Cost you will incur when you are retired. That’s the second most important decision for your financial retirement plan. Most folks overlook this cost, and it may be their largest routine monthly expenditure. Nest Eggers keep this cost to a small fraction of one percentage point. We simply keep 98% of what the market gives all investors. Investing Cost is far down our list of our routine expenses. Calculate your Investing Cost now. Lower it to get close to the cost of hardcore Nest Eggers.

* More precisely these are expenses deducted from a fund’s average net assets, but it’s fair to think of them as a reduction in the returns a fund could give you.

Apple, iPhone, and iCloud are registered trademarks of Apple, Inc.