Are we overdue for a big dive in stocks?

Posted on April 29, 2022

Returns for stocks and bonds are down sharply this month and year to date. In the last week or so, I’ve read a number of articles implying that we retirees should be nervous: we should be lowering our spending; we should be taking special cautions to protect our portfolio. The implication is that we are headed for a period of sharp decline; an implicit assumption is that returns have been too good recently. The purpose of this post is to emphasize that you should plan on NO DECLINE in your current Safe Spending Amount (SSA. See Chapter 2, Nest Egg Care [NEC]). You hit a high-water mark in your last calculation, and your SSA does not decline in spending power, essentially for the rest of your life. That’s the most important consideration.

== The recent past: how good? ==

A friend of mine said that the most recent past has been the best bull market for stocks in history. Is that true? No.

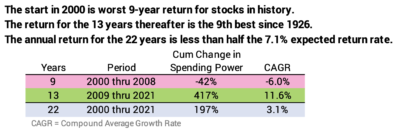

Stocks have had a very good run for the past 13 years. They’ve averaged 11.6% real return per year from 2009 through 2021. That’s well above the long-run, historical return rate of ~7.1% per year. I can calculate returns for all 13-year return periods. I find this most recent one is the ninth best since 1926. It’s an excellent return period, but it’s not a shocker.

We also need to put the last 13 years in context: the last 13 years followed the worst 9 years in history: stock declined in real value by 42% from 2000 through 2008. Wow. (Bonds performed well above average for this period.) One would expect stocks to rebound toward their long-run average of about 7.1% real return per year. The rebounded mightily, but over the past 22 years stocks have averaged 3.1% real return, well below their expected 7.1% annual return rate.

== Are stocks too high? ==

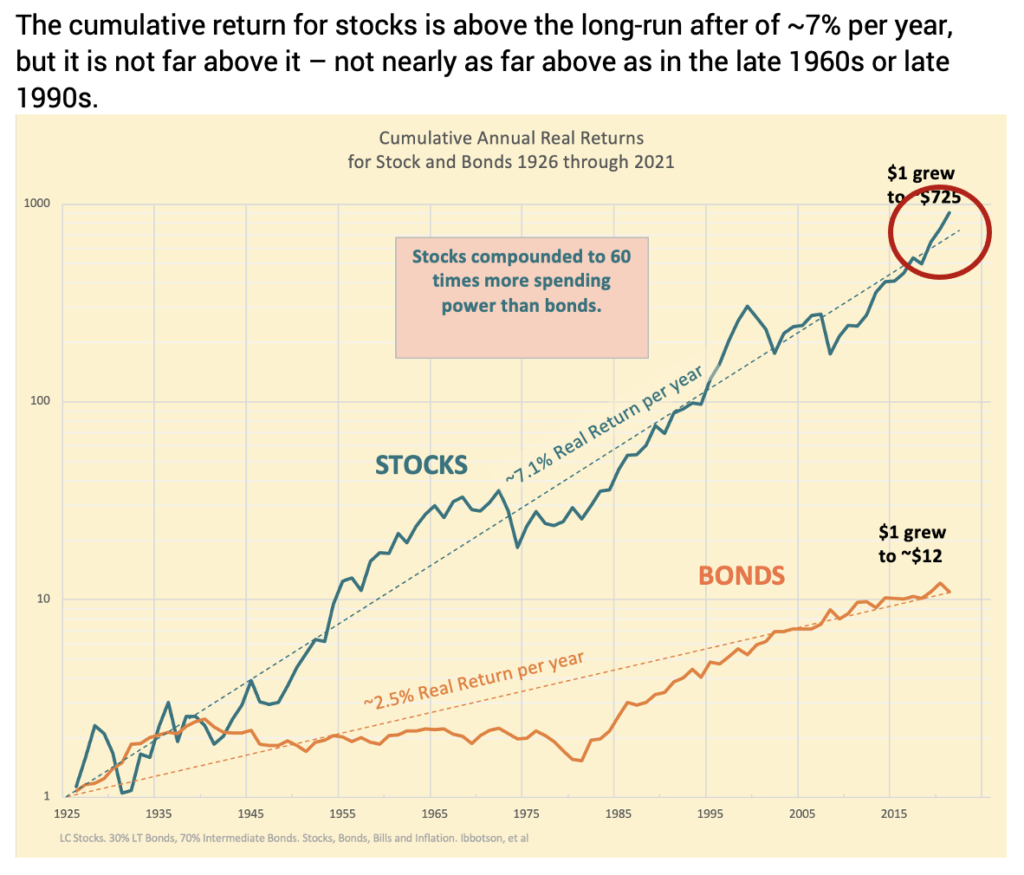

You can find lots of sources that say the market is overvalued and will decline. Some of these predictions are downright scary. I don’t put much faith in those predictions. I see little reason to argue the future trend line for returns will be different than the past. The cumulative return for stocks is above its historical average 7.1% trend line shown on this graph, but it is not wildly above the line as in the late 1960s or 1990s.

== Our SSA will not decline ==

Patti and I recalculate each November 30 to find our Safe Spending Amount for the upcoming year. I’ll assume you use the same date: you calculated to at least a 10% increase in your SSA this past November. You calculated to your peak SSA. Following the worst-case planning in NEC , it will never be less than that. You know you have very, very close to ZERO CHANCE of being able to spend that amount – in constant spending power – every year for your remaining years.

I worry very little about declines in our portfolio. I can’t worry that our current SSA is too little for us. Patti and I have been at this a number of years now. Our SSA is close to 50% greater in real spending power than it was at the start of retirement, and we were happy with it then. I spend no emotional energy thinking that we might run out of money. If we need to revert to lower spending – lower the SSR% we use to calculate our SSA – we’d extend our years of Zero Change of depletion beyond the age of 95. And that is still assumes we strike out and hit the 1 in 150 chances of riding a sequence of return that matches effect of the most harmful sequence in history.

I have other things I should worry about: will I make it to my life expectancy – less than 11 years now? Will both Patti and I be alive for that many years? Will we be both be healthy enough to travel to enjoy the money that we pay ourselves.

Conclusion: I keep reading articles advising retirees about what to do to protect themselves from lower returns and higher inflation. I really don’t worry about a decline in my portfolio. Like all nest eggers, our Safe Spending Amount is the highest it has ever been. Patti and I have experienced an increase of nearly 50% in real spending power for our SSA over the past eight years. You would have seen a similar increase: your SSA, effectively, has increased more than 50% over the same eight years, even though you likely didn’t start your retirement plan then: you haven’t withdrawn nearly as much as we have. Focus on your SSA: it won’t decline in spending power essentially for the rest of your lives. Distance yourself from the anxiety or worry about declines in your portfolio and the risk of running out of money.

Another excellent post from Professor Nest Egg. I especially like the top-notch illustration. It’s a mental struggle to believe a high water mark on a swimming pool wall will magically catch a swan dive into a shrinking puddle below, but Tom’s analysis makes me confident to make the dive, (As if I have a choice, eh?)