Monthly Older Posts: January 2023

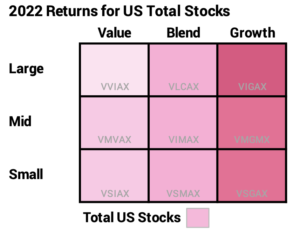

What segments of US stocks outperformed in 2022?

I like arranging the most recent calendar year returns in the 3 by 3 matrix of the Investment Style Box. I get a snapshot of what outperformed and what underperformed the US stock market as a whole. This post shows the nominal return for