What’s my checklist of tasks to get ready for December 1?

Posted on November 25, 2022

I use November 30 as our calculation date to determine our Safe Spending Amount (SSA; Chapter 2, Nest Egg Care (NEC) for the upcoming year. This post shows the checklist I ran through this week. I think November 30 is a good 12-month calculation date: my checklist may be helpful to you. I have one mechanical change from my normal process, and I find that Patti’s life expectancy is a bit longer than I had found before.

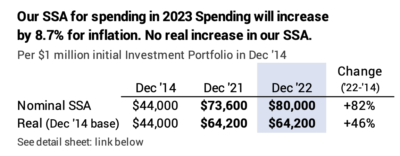

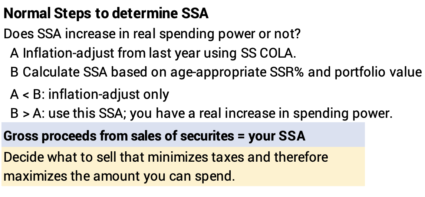

1. Review the amount we will have or want for spending for 2023. Returns clearly won’t be good enough to support a real increase in our SSA. Our SSA – the gross amount of securities I would normally sell – will be last year’s SSA adjusted for inflation: +8.7% using Social Security’s COLA.

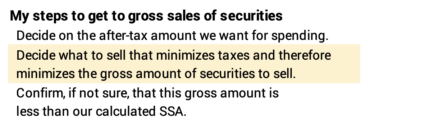

Patti and I won’t be paying ourselves the SSA I would normally calculate. I went through the exercise this year to understand our spending needs and desires. See here and here. I basically plan for our total pay (SS, other pension income, and payments from our next egg), net of taxes, to be 10% to 15% greater that we will generally spend in a year; that’s a pretty big cushion, and I like it that way. The part from our nest egg works out to less than our calculated SSA. Patti and I can start from what we want to pay ourselves since our calculated SSA has outpaced our spending. I start with what we want to pay ourselves, net of taxes, from our nest egg: I work from there to get to the gross value of securities I need to sell.

2. Review my tax plan that I first drafted in early August to make sure I am happy with what I am selling to get the net after taxes. We have to take our RMDs, but that is not enough for our total spending desires, so I need to decide what I will sell to get the balance: securities in our taxable account with capital gains or securities with no taxable income from my Roth account.

I’m generally trying to minimize Federal and State taxes for our current-year tax return and therefore minimize gross amount of securities we will sell. I usually hoard my Roth IRA to use when I can keep our Adjusted Gross Income (AGI) below a tripwire that triggers higher Medicare premiums (Part B and D). The first tripwire, based on AGI on our 2022 return, would cost the two of us ~$2,000 in greater premiums – lower SS payments – in 2024.

This year will be different: I’m not following my normal practice of selling securities in December to get our 2023 spending into cash before the start of the year. I won’t have any year-end sales from our taxable investment account. I’ll be selling monthly throughout 2023 to get the amount to be transferred to our checking from our investment account.

The capital gains that I would have recorded this year basically shift to the 2023 tax year. Shifting won’t have that much effect on our total 2023 taxes, since our RMDs will be less than this year.

3. Decide on the securities to sell in our IRAs for taxes to be withheld for our 2022 tax return. My tax plan gets me very close to the amount I need to withhold for federal and state taxes. I don’t like selling at what may be a very low point, but I have to get cash for taxes.

I will sell bonds and no stocks – that will be IUSB – to get this in cash from one or both of our IRAs. My sale of IUSB will settle a day or two after December 1. I’ll call and ask Fidelity then to directly withhold this amount for the IRS; our state taxes will be very low this year, and I won’t worry about that withholding.

This is my usual pattern: I withhold in December the total taxes I will pay for the current tax year; I generally do not pay quarterly estimated taxes. I suffer no penalties from late payment of taxes when I withhold close to our total taxes.

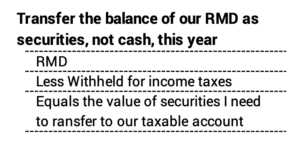

4. Pick the securities that Patti and I will transfer in-kind from our Traditional IRA accounts to our taxable account. This is the balance of our RMD after withholding taxes and this choice is again easy: solely bonds.

I plan on using the automatic sell & transfer feature at Fidelity for our monthly paychecks from our nest egg throughout 2023. This feature does not work with IUSB: Fidelity’s process works by selling an amount from a mutual fund and not ETF (IUSB) or other stock shares.

I chose to sell IUSB and buy FTBFX – Fidelity Total Bond fund – in our IRAs on Tuesday. I’ll call Fidelity on December 1 to execute the transfer of the shares of FTBFX that will be the balance of our RMDs. (As an alternative, I could have sold IUSB in our IRAs, transferred the cash, and then bought FTBFX in our taxable account.)

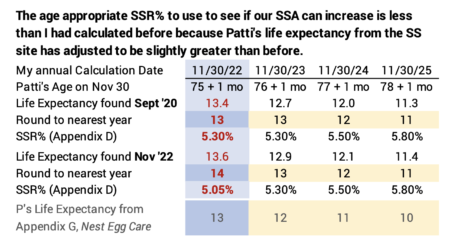

5. Check my calculation of Patti’s life expectancy. Patti’s life expectancy leads to the age-appropriate Safe Spending Rate I test to see if our SSA can increase in real spending power (SSR%; Chapters 2 and 4, NEC). The SSR% for this year clearly won’t figure in the calculation, since I know I can only inflation adjust this year. But I should see if my table, similar to the one I prepared in Appendix G, NEC is accurate.

I now use the Social Security (SS) Life Expectancy Calculator to find Patti’s Life Expectancy. I checked last checked on Patti’s life expectancies in 2020, and SS’s years were roughly one year greater than I had obtained seven years ago with the Vanguard Probability of Living Calculator, which no longer exists.

My check this week shows an increase from my table from two years ago. The SS Life Expectancy Tables and algorithm that predicts future mortality at any age adjust over time. Typically, this results in a progression of slightly longer life expectancies for any age.

My new table shows Patti’s life-expectancy is about 0.1 or 0.2 years greater than I last displayed. Rounding means that I need to change the SSR% that I had for this year’s calculation: I had her life expectancy for this as 13 years and it now rounds to 14 years. For accuracy, I need to change our age appropriate SSR% for this year’s calculation to 5.05% from 5.30%. Again, that won’t make a difference our SSA, since I’ll only be inflation-adjusting last year’s SSA.

6. I made of copy of my long form calculation sheet from last year and got it ready for the entries from the November return data I’ll get on December 1 (See here). 1) I filled the columns and formats as much as I can for this upcoming calculation. 2) I added 8.7% as the inflation adjustment I’ll use to adjust last year’s SSA to maintain the same spending power. 3) I corrected the age-appropriate SSR% for this November.

Conclusion: My 12-month calculation date for our SSA is November 30. I spent some time this week on a short checklist of tasks to be ready for the final calculations. The mechanics will be a bit different this year: I won’t be selling securities as part of our RMD; I’ll be transferring shares of a mutual fund and sell that on a monthly schedule throughout 2023. I found Social Security’s estimates of Patti’s life expectancies are a bit longer; this resulted in a change in my table of age-appropriate Safe Spending Rate (SSR%) to test to see if our Safe Spending Amount (SSA) might increase in real spending power.