What do we do to lower risk in our financial retirement plan?

Posted on December 14, 2018

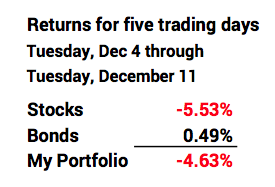

The calculation year for Patti and me ended November 30. I sold securities the next business day – Monday, December 3 – to get our total Safe Spending Amount (SSA) for 2019 into cash. Then my portfolio took a sudden, steep hit. My stocks declined by more than 5% in five trading days, and as of this morning they are down more than 5%. It’s a good time to remind myself what to do to lower risk in our financial plan during our retirement. I think a recent article looks at risk the wrong way and gives the wrong advice for us retirees. The purpose of this post is to describe how I’m thinking about this decline and the priority of actions to reduce risk in our portfolio.

==== What is risk? ====

Let’s make sure we agree on the definition of risk. Risk is variability or uncertainty of a future result. The uncertainty we nest eggers are worried about is the point of time (years) in the future where we have the first possible chance of depleting our portfolio. That’s completely different from the weekly, monthly or quarterly change in the value of our portfolio. This five-day decline is a small blip on the path that we are concerned about – a most horrible sequence of annual returns that stretches for perhaps 15 or more years and sinks our portfolio.

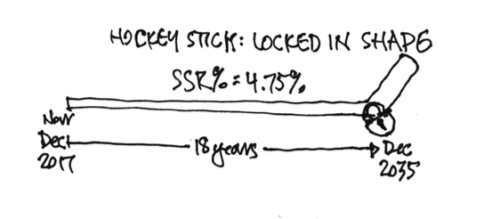

Patti and I have no risk or uncertainty in our plan before December 2035. We have zero probability of depleting our portfolio before then. That’s Patti’s age 88 and my age 91. We’re operating on the same plan – the same Safe Spending Amount (SSA) derived from the Safe Spending Rate (SSR%) that we updated and set last year. Our plan – the plot of the probability of depleting our portfolio – looks like a hockey stick with the exact same shaft length before its inflection point as last year: it’s December 2035 before our plan budges off zero probability of depleting.

I know that 2035 is locked in because I used the most horrible sequence of market returns to get to our Safe Spending Rate (SSR%); I also had to lock down two other key decisions: investing cost and mix of stocks and bonds. But if we need to or want to, Patti and I can always change those decisions during our retirement to extend past 2035.

==== I have years to recover ===

Right now I have three years before I have to worry about what happens to stock returns. I can wait three full years before selling any stocks for our spending. Why is this? I executed all the transactions to get to our SSA into cash and to rebalance our portfolio on Monday, December 3. (The market was up that day, so that was a good day to sell.) It’s now about 50 weeks before I recalculate and sell for our SSA for 2020.

Patti and I also have two years of off-the-top Reserve in short-term bonds. Patti wanted what I consider an extra year of spending in Reserve at the start of our plan. (See The Tom and Patti File for Part 2, page 63, Nest Egg Care). That decision on our Reserve effectively lowered our initial Investment Portfolio (our total less our Reserve) and therefore our Multiplier that we use for the calculation for our annual SSA.

==== Lower risk while retired ====

The priority of actions to further lower risk are clear. It is not difficult to add more years of zero probability of depleting after we have started on our plan. We can add years to the shaft length of our plan. (You always lower risk and extend time to the shaft of your hockey stick when you lower your Investing Cost. I don’t think this makes the list of advice from any financial advisors, though. If you are a true nest egger, you’re already at rock bottom Investing Cost.)

How do I extend shaft length? First, if I’m faced with horrible returns next November 30 I’ll tap our off-the-top reserves for our spending for 2020 – not our Investment Portfolio. (See Chapter 7, NEC.)

Skipping a year extends shaft length by at least one year. You can see that effect yourself by playing with FIRECalc. (You’ll have to input a manual spending plan; you can do that if you are a supporter of FIRECalc.) Alternatively, you can use the spreadsheet I provide in this post. That spreadsheet uses the most horrible return sequence for stocks and bonds that I could find – the one that results in the shortest time to depletion for any spending rate. Just change spending in a future year to zero to see the effect – you’d be skipping that year of spending from your Investment Portfolio because you are using your Reserve. Obviously, using the second year of the Reserve that Patti and I have – to again avoid tapping our Investment Portfolio – pushes that date even further into to the future.

Finally, we can always simply spend less over our complete retirement period. A small change in spending has a big effect. Our 2019 spending of $55,500 relative to an initial $1 million Investment Portfolio value is 20% more than we started with. It would not be hard for us to go back to our initial spending level – $46,300 in today’s dollars. We would not be limited in what we want to do to enjoy. As explained in this post, dropping back to that spending level now adds another three years of zero probability of depleting.

We also have other deep, deep Reserves that I rarely think about. The chance that I’ll reach into these reserves is pretty remote: we started 529 plans for heirs with Patti as the “owner”; we can always pull that money back for our spending. I have a home equity line of credit I could borrow against. I have taxable securities that provide borrowing power (marginable securities). We have growing equity in our home that I can convert to cash through an increased home equity line of credit or reverse mortgage.

Conclusion: Our Recalculation date is November 30. I sold securities to get our 2019 SSA into cash the next trading day. Then I was hit a five-day bump in the road – more than 5% decline in stocks. I don’t feel worried, since it’s almost a year before I have to sell securities for spending. With our added two-years of spending in Reserve, we really don’t need to worry about selling stocks or bonds for three years. And in worst case, we can drop back and spend less. That would not be a hardship for us.