Nest Eggers: my Investing Cost dropped by 30%. Yours dropped or will soon.

Posted on August 24, 2018

My Investing Cost (my net cost reduction from market returns I assume in my financial retirement plan; and it’s really for Patti and me) has just dropped about 30%. Wowee. I thought it was as low as it could get, but I was wrong. We (Patti and I) save $20 per year relative to every $100,000 invested. We will now pay $50 per year (.05%) rather than $70 (.07%). Lower cost is always good, but lower than low is not earth shaking. It doesn’t change the key decisions for our retirement plan: when I run FIRECalc to see the effect, I see the time for zero chance of depleting our portfolio (e.g., the 19 years we set at the start of our plan) extends by just a few weeks.

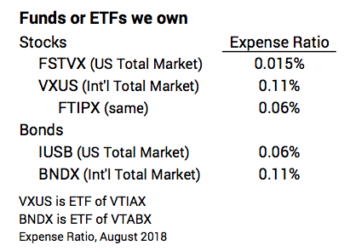

Why did our Investing Cost drop? Our investing cost dropped because the expense ratio of our largest single holding dropped by nearly 60%. Fidelity cut the cost for their US Total Market Index fund to .015% from .035%.

Fidelity also lowered the expense ratio of other index funds. I also own FTIPX, Total International Index. It did not exist when I started our plan in 2014. I purchased some this last December as explained here. Fidelity cut its cost to .06%. I’ll watch to see if that translates to slightly better return to investors than my original choice, VXUS.

Here are our holdings and their expense ratios. When I weight them by the percentage that we own of each, our personal Investing Cost adds up to less than .05%.

========

Why will our (and your) Investing Cost drop again? It’s a war out there. Three brokerage companies, Vanguard (funds and ETFs), Fidelity (funds) and Blackrock (ETFs) battle to see who can have lowest expense ratio for index funds. They’ve all steadily cut their expense ratio. I have to think that Vanguard at least will respond and lower their cost again. We might get to keep another $5 or $10 per year!

========

Fidelity just announced two new funds available to its customers that have 0% expense ratio! FZROX is for US Total Stock Market, and FZILX is for International Total Stock Market. Wow. You can read more here and here.

I read the Fidelity report on Index Methodology. Interesting. Fidelity has designed the indexes (baskets of stocks; process by which stocks are added or subtracted). Fidelity is doing this to avoid fees it would pay to companies who independently establish indexes, such as S&P Dow Jones, CRSP, Barclays, MSCI, and others. Brokerage houses typically pay fees to those companies to use their indexes as benchmarks and then do their best to have their index funds match. Fidelity’s construct may not be the same as the others. I’m not chasing after those 0% funds until I understand their performance for investors over time.

Conclusion: The expense ratio (our Investing Cost) of index funds keeps falling. It’s a war out there to see who can be lowest cost. The weighted Investing Cost of our portfolio has declined to less than .05%. That just means Patti and I get to keep more of what the market will give to all investors over time. I used to think we’d keep 98% of what the market will give. Now I think it’s 99%.