Now that you’re retired, how do you invest?

Posted on June 29, 2018

You make two basic decisions for your financial retirement plan: How Much to Spend and How to Invest. It’s actually three decisions:

1. How Much Should I (we) Spend (Spending Rate)?

2. How Do I Invest?

a. What Investing Cost Should I incur?

b. What’s a proper Mix of stocks and bonds?

Nest Egg Care helps you make those three decisions. Most financial advisors and most folks only focus on the latter one of the big two, How To Invest. Most TOTALLY IGNORE 2a. (Do you ever wonder why financial advisors steer clear of that one?) Those three decisions are interrelated, so it isn’t that easy to give advice on one without considering the others. But here’s my quick summary on that second basic question: How Do I (we) Invest (2a and 2b)? Do these four things and your retirement will be MUCH better.

=== KEEP (ALMOST) ALL OF WHAT THE MARKET GIVES ===

1. Only invest in Index Funds.

You want to keep as much of what the market will give to investors in the future. You have two choices. The right choice is to reliably keep (almost) all that the market will provide to all investors: invest in Index funds that mirror market returns less a very small cost. You forego the possibility of ever beating the market. You will reliably keep about 98% of what the market returns. Your total Investing Cost can be less than .07% per year. This choice will place you in the top 6% (or better) of all investors over time.

2. Do NOT bet on Actively Managed funds.

Investing in Actively Managed funds is the second option, and this is the wrong choice. Investing in Active funds is a fool’s errand. It’s mathematically impossible for Actively Managed Funds in aggregate to outperform their peer Index Funds. Actively Managed funds MUST underperform their benchmark Index Funds by the difference in their costs (Expense Ratio).

All sorts of studies tell us this is true. About 94% of Actively Managed funds underperform their benchmark index over a 10-year period. In aggregate they return about 1.2 percentage points less than their benchmark index. Active fund investors in aggregate keep just about 85% of what the market gives. That typical 1.2 percentage point deficit compounds to a huge dollar disadvantage for Active funds. You’re nuts to plan your retirement financial plan based on the ability to be able to pick the one in ~20 funds that will outperform. See Chapter 6 Nest Egg Care.

=== KISS: KEEP IT SIMPLE, STUPID ===

3. Invest in just a few Index Funds.

Patti and I only invest in four broad-based, market-capitalization-weighted mutual funds or their sister Exchange Traded Funds (ETFs). Two for stocks and two for bonds. Those four own a piece of 20,630 individual securities. That’s approaching ALL the traded stocks and bonds in the world. That’s almost the ultimate in diversification. You don’t need more funds than that, and you don’t need to own more stocks and bonds than that.

Biases in our brains work against simplicity and KISS. Our brain thinks that a portfolio with many funds or stocks gives greater diversity and therefore safety. But that’s an illusion and is not true. Owning more funds doesn’t mean you own more securities and are more diversified.

There’s no good argument to overweight your portfolio to hold more of different kinds of stocks, for example. A favorite recommendation is to own more small-cap stocks, but that tactic has made no difference over the last 30 years. If you decide to overweight one kind of stocks over others, you’re only guessing as to what will be the leader in returns.

=== STEER A STEADY COURSE ===

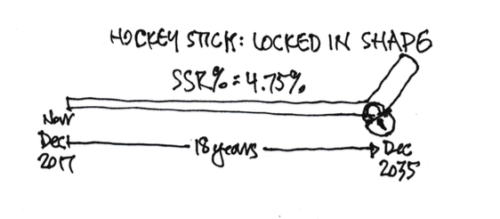

4. Don’t obsess, worry, and panic over Bad Variability of one-year returns. Our focus has to be on the decisions that make sure we don’t outspend and outlive our our portfolio. That (hopefully) is a distant point in the future, perhaps decades away. It’s that point far down the shaft of your hockey stick. (A plot of the year-by-year probability of depleting a portfolio looks like a hockey stick: many years of zero probability of depleting and a rising probability of depleting thereafter.)

That point down the shaft has what I call horizontal variability (the variability in the number of years of zero probability of depleting a portfolio). A Retirement Withdrawal Calculator tells us how to make the three key decisions that lock in that point, and you can decide and move that point farther away during retirement. Vertical variability (the annual ups and downs) has already been assumed and accounted for by our Retirement Withdrawal Calculator.

Patti and I know our hockey stick. It has zero probability of depleting our portfolio through 2035 – 18 years away. That’s to Patti’s age 88 and my age 91. (Unfortunately, it’s just over 8% probable that both of us would be alive then.) As a result, we pay little attention to the annual variability of returns. (But that’s been easy over the last four years since the start of our plan – only a tiny decline in one year.)

5. Don’t try to time the market.This is one of the biggest mistakes an investor can make. No one can reliably time the market. It makes NO sense to shift your mix of stocks to bonds or move to cash as a result of Bad Variability (panic in after a down year) or Too Good of Variability (guessing the stock market is overvalued). Set your mix of stocks and bonds and forget it. (You’ll Rebalance to your choice annually, though).

=== MIX: NOT SO TOUGH A DECISION

IF YOU THINK IT THROUGH ===

6. Your decision on the mix of stocks and bonds requires some hard thinking and understanding of the tradeoffs among your choice of spending rate, investing cost, and mix of stocks and bonds. Saying that differently: your choice of Spending Rate and Investing Cost makes the decision on Mix a pretty easy one. But the emotional part of your brain will tell you to hold more bonds that the thinking part of your brain will tell you.

I cover this decision in Chapter 8 in Nest Egg Care. For this post, I’ll give a few quick views.

a. Think of Bonds as insurance. Many think they should hold bonds to smooth annual variability of returns, and that’s not the right way to think about them. You own bonds to extend and protect that distant inflection point on the shaft of your hockey stick. You have bonds so you don’t have to sell stocks (or as much stocks) in a year when they’ve cratered. (Historically they crater one in ten years.) When you sell a disproportionate amount of bonds, you’re cashing in on your insurance in that year.

b. You actually don’t want too much insurance (bonds). The average annual, real return for stocks (above the rate of inflation) is about 6.5% to 7%. Bonds 2.6%. When we experience normal sequences of market returns – and that’s most likely – holding bonds grows to be very expensive. Those return difference compound to huge dollar differences: stocks typically will double in purchasing power about every decade; it will take bonds more than 25 years to double.

Conclusion: Now that you are retired or nearly so, the rules or rationale of How to Invest are not very complicated. You really get to understand and believe the rules when you put a Retirement Withdrawal Calculator through its paces to decide your 1) spending rate, 2) investing cost, and 3) mix of stocks and bonds. (That’s what Nest Egg Care does!)