Can you pick a winning Actively Managed fund based on its past results?

Posted on July 27, 2018

The SPIVA® report, “Does Past Performance Matter? The Persistence Scorecard” answers the question. Don’t count on an excellent track record of performance of an Actively Managed fund to extend into the future. Excellent performance does not persist. Only a very small percentage of funds with good performance in one year repeat in each of the next two or four years. A significant percentage of funds that are top performers in one year (top quartile) transition to bottom performer in a few years (bottom quartile). I summarize the SPIVA report in this post.

========

This SPIVA report is a companion to another SPIVA report I discussed here and here. We found the following in that report:

• Over a three-year period, the cumulative return of 85% of Actively Managed funds did not match their benchmark index. On the same basis, 94% did not match their benchmark over 10 years.

• Over the past 15-years, the average Actively Managed fund underperformed its benchmark by about 1.2 percentage points per year. That’s about 1/6th lower real return rate for stocks. Over a ten-year period, that difference compounds to lower real spending power equal to about 20% of an initial portfolio.

• Over 15 years, Actively Managed funds that performed well – at the 75th percentile of peer Actively Managed funds – underperformed their benchmark by .5 percentage points per year.

========

We have a human bias that tends to fight what we’d conclude and do with this information. We believe we have better than average skills in recognizing patterns, and we (or someone we hire) can find the few Actively Managed funds that can beat the odds. I’ve heard this expressed in the following way, “Just don’t pick the funds that will underperform. Only pick the ones that will outperform.” Can we do that? This SPIVA report says, “No”.

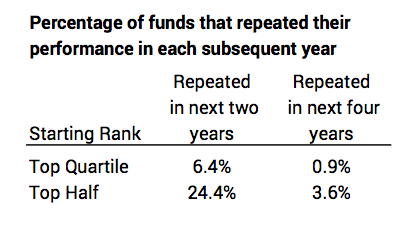

1. We can’t judge the future based on historical results. Excellent performance does not persist. SPIVA measures persistence of better performance for Actively Managed funds over two and four-year periods.

• Funds in the Top Quartile (better performance than 75% of all funds): 6% of 560 Actively Managed funds in the top quartile of performance for the year ending September 2015 repeated that performance in each of the next two years. (Only 18% of the 560 repeated to be in the top quartile the next year; data not shown in the table above.) The fall off in persistence continued: only 1% of top quartile funds in the year ending September 2013 repeated that performance in each of the next four years.

• Funds in the Top Half: 24% of those funds in the top half of performance for the year ending September 2015 repeated that performance over each of the next two years. About 4% of top half funds in the year ending September 2013 repeated that performance in each of the next five years. (The report says that 6% would outperform following a general pattern of randomness; the actual results were worse than expected random results.)

2. The SPIVA report tracks the movement of funds to different quartiles of performance over time: a significant percentage of funds that perform in the top rank in one-year drop to the bottom rank in a few years. And a significant number of funds that perform in the bottom rank in a year rise to top rank in a few years.

• Over five years, 28% of those that started in the top quartile in a year wound up in the bottom quartile in the year five years later. 18% of those in the bottom quartile for a year wound up in the top quartile five years later.

Conclusion: Two prior posts summarized a SPIVA® report on cumulative performance of Actively Managed fund relative to their benchmark index (e.g., Large Cap Growth funds vs. the Large Cap Growth Index). That report concluded that, over time, 94% of Actively Managed funds underperformed their index. (Given the low, low Investing Costs [Expense Ratio] of Index funds, this means that Index funds will be about the 94th percentile rank of all Active + Index funds.)

But despite those low odds of success, we’d all like to think we are smart enough to be able to pick the funds (or hire someone to pick the funds) that will outperform. We all look to past performance as the guide and think that works. The SPIVA report summarized here says that there is almost no predictability of future performance based on past results. You’re really betting against the odds when you invest in Actively Managed funds.

Hard core Nest Eggers only invest in Index funds. We stick with a predictable, very small Investing Cost that’s a deduction from Market Returns. (Mine is less than .07% cost in total.)