What are the basic steps to rebalance your portfolio?

Posted on July 10, 2020

Ages ago – over a year ago, I think – the links broke under the Resources tab on this web site. Nothing downloaded when you clicked on the resource. Reader Jeff asked me for replacements. I emailed them to him after I had updated a few. I got the links fixed, but, shame on me, I never added the updates to the web site. The purpose of this post is to simply inform you: I posted in the Resources section my latest spreadsheet to help for your annual Rebalancing task. I think it’s simpler to understand than the one I had there before.

== Why Rebalance? ==

You Rebalance your portfolio once a year to get back to your design Mix of Stocks and Bonds. (See Chapter 8, Nest Egg Care.) Throughout the years – not every year – you will be selling stocks to buy bonds as your final rebalancing task. That’s because over time stocks most certainly will outperform bonds. You’re doing this to renew your insurance coverage. You want to have enough bonds to sell much more of them for your spending when stocks crater: when stock crater, bond returns have always been MUCH better. You can also think of it this way: you are selling more bonds than stocks to give stocks time to recover.

== Rebalancing: not like falling off a log ==

I struggled when I first tackled the task to Rebalance. I thought this was trivial math and steps. I had to think through the steps and go through it a couple of times to get the hang of it. Follow the spreadsheet, and it will be a lot easier for you than it was for me when I first started to figure out how do this.

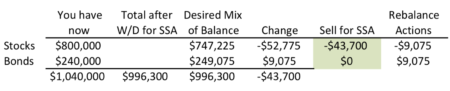

The simple key for the Rebalancing task is to first subtract your withdrawal for your upcoming spending in the year – your annual Safe Spending Amount (SSA; Chapter 2, Nest Egg Care) and then rebalance the remainder. I think you get the picture of this logic in the display here (The SSA withdrawal is $43,700.), but you can follow the detail I describe for this example in the spreadsheet.

As the last step – or near the last step – you decide how much Stocks or Bonds to sell for your SSA. After you sell, you still may have transactions to get to your desired Mix of Stocks and Bonds.

== It can get more complex ==

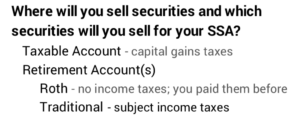

Each year you will sell securities from one of three sources: 1) your Traditional IRA accounts (You’ll definitely be selling from here if you are subject to RMD.); 2) your Roth IRA account(s), or 3) your Taxable account(s). Each has its tax implications, and each sale of an individual security within your Taxable account will its own tax implications.

When you work hard to minimize taxes to keep the most after taxes for your spending, you’ll make your Rebalancing task more complex.

For example, one year it was clear that I should sell stocks out of our taxable account, but bonds were much lower in capital gains and therefore lower tax cost. I decided to sell bonds to give us a greater net for our spending.

I’m not really saving on taxes. I’m deferring taxes to a later year when I’ll have to sell those stocks with greater capital gains. But my thinking was that I wanted the most net from my SSA now; my SSA will be greater in the future; our ability or desire to spend will be less then; the effect paying somewhat higher taxes later won’t have as much effect on the net amount we will have to spend to enjoy.

That move to sell bonds meant I was going the wrong way on my Rebalancing. To get back into balance I had to shift more dollars from stocks to bonds in our Retirement accounts – the final Rebalancing step. This may sound strange. You’ll likely just have to go through this a time or two to get the hang of this.

Conclusion: I assume you’ve decided to take your withdrawal for your Safe Spending Amount (SSA) for the upcoming calendar year in early November or December (like Patti and me). After you’ve your withdrawn your SSA, you should Rebalance your portfolio to your Mix (Stocks vs. Bonds) and Weights (US vs. International) that you set at the start of your plan. Rebalancing may be easy to describe, but it was a bit confusing for me for a couple of years. My advice is to use the spreadsheet I provide in Resources to help you with this task.