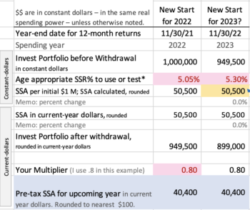

Use this sheet next year for your Recalculation of your Safe Spending Amount for 2023

Posted on December 10, 2021

Here’s a spreadsheet that you can download and use to Recalculate to see if your Safe Spending Amount (SSA) will increase in real spending power for 2023. (SSA; See Chapters 2 and 9, Nest Egg Care [NEC]) This sheet is similar to the one I provided last year; I revised it slightly. You can also find this sheet in the Resources section of the web site.

== One significant change ==

I apply my design mix to my total portfolio: the amount I had as of November 30 after withdrawing our full-year SSA for 2022. I no longer have a Reserve hidden under our bed that I keep separate from the rest that I called our “Investment Portfolio.” (See Chapters 1 and 7, NEC.)

The change follows the logic in this post: I clearly view bonds as insurance that I may or may not have to use during retirement.

• In all normal years from the start of our plan I Rebalance back to our design mix to maintain our original level of insurance. I’ve rebalanced back to 85% each year for Patti and me.

• In an abnormal year (none since 2008, 14 years ago ) I’ll solely sell bonds for our spending. At a mix of 85% stocks and roughly 5% withdrawal rate, Patti and I have three years of insurance.

An abnormal year is when we are hit by a tornado. I set the mark for a tornado as -12% or worse real return for stocks. Tornados have hit ten times in the 96 years since 1926: call it a one-in-ten-year event. I’ll solely sell bonds for our spending, and I’ve used one-year of insurance. I won’t replace it in a future year by rebalancing back to our initial design mix. I’ll have two years of insurance, meaning I’ll have a greater mix of stocks. I hope to heck that I never use our insurance and Really Hope not to use it more than once during retirement, but chances are that we all will be hit at least one time in our retirement.

There are no other significant changes from the sheet last year; some of the text is clearer, I think.

== Store it prominently ==

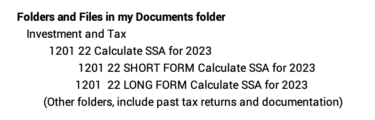

My file name is “ 1201 22 SHORT FORM Calculate SSA for 2023.” (I also have the file for the LONG FORM for the total history since 2014 in the same folder.)

I’ve stored both those sheets in a folder called “ 1201 22 Calculate SSA for 2023.” I skip a space or two before the text so they display in the order I want. That folder is in the big folder “Investments and Tax” in my Documents.

== Set up the sheet==

You’d change this sheet enclosed to reflect your plan:

1) List your securities in cells C30 to C33. You’d change the math in cells D30 to D33 that reflect your decision on mix/weights of the securities you own. You can refer to a small table to the right of those cells.

2) Enter your Multiplier for cell C21. (I show .80 as an example.) It won’t be the same as the one you used last year. You have more after your withdrawal this year than you did after your withdrawal last year. This assumes you did not take out some of your More-than-Enough for year-end gifts or donations.

3) Enter your age adjusted SSR%s for cells C14 and D14 that you get from Appendix D, NEC. I show the ones for Patti and me on the sheet. I describe how I get the life expectancy calculation for this in this post: I use the Social Security Life Expectancy Calculator for Patti and round the years for November 30.

== During the year ==

I’ll look at this sheet in early August when I make my first attempt at tax planning for 2022. I’ll get an idea of our SSA for 2023. I’ll estimate how much securities I will be selling in December and figure out where it is best to sell them: Traditional IRA, Taxable account or Roth IRA.

In mid-October when Social Security announces the Cost-of-Living Adjustment for the year, I’ll enter inflation in cell C28.

Conclusion. I Recalculate each year to see if I’ve earned a real increase in our Safe Spending Amount for the upcoming year. If not, I stick with last year’s amount and inflation adjust it. (You can Recalculate less frequently if you like.) I enclose in this post a short-form spreadsheet you can set up now for your Recalculation next year.