How will lower RMD percentages in 2021 affect you?

Posted on February 14, 2020

The IRS published proposed changes to RMD percentages in November. The rule making process will be completed this year and new, lower RMD percentages will likely take effect for 2021. This post describes those changes and what I think that means for us retirees. My conclusion is that the changes don’t really mean much to you. Here’s a short summary article on the changes.

== RMD Factor and percentages ==

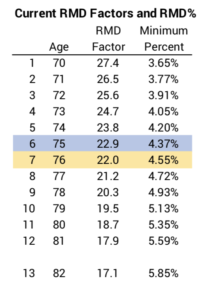

RMD percentages for our IRAs or 401k for all almost all of us – married or single – are determined by the Uniform Lifetime Table published by the IRS.* The Table displays RMD Factors – IRS calculated life expectancies – for each year of age. The Table basically assumes you are married and your beneficiary (Patti in my case) is ten years younger than you and uses the life expectancy of that younger person for your “RMD Factor”. This table shows current RMD Factors for the first dozen years of RMD. The inverse of each factor is RMD%.

My current RMD% for this year – age 75 – is 4.37% and next year it would be 4.55%

== RMD% isn’t connected to SSR% ==

The IRS makes no judgement on how the RMD% will affect the value of your IRAs over time. RMD%s are meant to be low enough so your retirement account easily lasts the lifetime of your beneficiary but are to be high enough to provide reasonable income. The IRS does not use a Retirement Withdrawal Calculator (RWC) to find your highest Safe Spending Rate (SSR%). That’s a whole different logic. [See Chapter 2, Nest Egg Care (NEC).]

Your Safe Spending Rate (SSR%) is always more than your RMD%. That’s primarily because the added ten years of your life expectancy is not appropriate for most all of us for the calculation of your SSR%. Patti is three years younger than me, not ten. Her life expectancy when we started our plan was 19 years, not 27. Our initial SSR% was 4.40% (See Chapter 2, NEC) in the year my RMD% was 3.65%. SSR% was about 20% greater RMD%.

== Don’t use RMD as a guide to spending ==

Some folks I know use their RMD is their target for spending. They don’t want to spend more than their RMD. They feel badly if they do spend more. Using your RMD as a guide means you are spending far too low of an amount to ENJOY. If I had done that for 2015, my first year for RMD, I would have ignored Patti’s IRA (She was not subject to RMD.) and our taxable assets as part of our nest egg. My RMD was a fraction of our Safe Spending Amount for 2015. I would have hated that.

Patti and I don’t want to make the mistake of spending too little at this stage in life. The driving issue for us is the shockingly low probability that both of us will be alive in, say, ten years. It was 50% probable that both of us would be alive in JUST 11 years at the start of or plan in 2015. (See Chapter 3 and Appendix E, NEC.) We’ve both lived five years, and I can calculate that that same probability is eight years now. We both want to live those years to the max – always paying ourselves our SSA and spending or gifting it all in the year. Those are also going to be our healthiest years.

== Higher RMD factors = Lower RMD% ==

Americans at all ages are living longer if one looks over long enough time period. Recently some age cohorts have seen declines in life expectancy (Blame the opioid crisis.), but we retirees are consistently living longer. Each cohort (age) lives a bit longer than the cohort from the year before: I’m 75; if I live to age 76, the probability that I will live to be 77 is just a bit – a very tiny bit – better than that probability for those age 76 now.

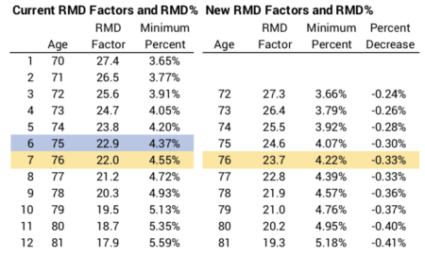

The IRS has not updated their life expectancy tables for 18 years, so that’s a lot of years to accumulate small annual increases in life expectancy for each year of age. The IRS new calculation of life expectancies conclude that appropriate RMD Factors for each age should be about 1.5 years more than those set in 2002. I show the changes for up to age 82; last week’s post explains why 70 and 71 no longer apply.

My RMD Factor for next year increases. My RMD% will be lower next year than this year: my RMD% for my current age 75 is 4.37%. It would have been 4.55% next year, but it will be 4.22% for 2021. If I had $1 million on 12-31-20, my RMD would have been $45,500 and the new RMD would be $42,200. I have to take $3,300 less from my IRA.

== What do these changes mean to us? ==

The economic effects of the changes are small as I discussed in last week’s post.

• You gain from lower total tax in the short term. In an example of $3,300 lower from RMD at age 76 would translate to about 15% less tax that year on $3,300 or about $500: that’s the differential between 22% income tax and 7.5% effective capital gains tax that I showed last week. You get a bit more to spend after taxes now. I like that, but that’s not a monumental amount.

That’s really a deferral in taxes. You’re using your taxable assets for spending a bit faster than you otherwise would. Your sources for spending will shift a bit faster from taxable accounts to your IRAs. Eventually you will be withdrawing more from your IRAs and your total tax, because of the higher tax rate on income, will more than you otherwise would have paid. You’ll net less.

• You gain a bit of wealth over time because you’re leaving a bit more – $3,300 more in the example – in your IRA account to compound tax-free. Growth of your investment in your IRA is effectively untaxed. That tax-free run will end when you withdraw for your spending in a future year. The amount of taxes you avoid on the growth of that $3,300 works out to a small difference per year – maybe a hundred bucks or so.

• When you take less from your IRA accounts, you are moving somewhat faster toward the day when your real RMD will double – assuming returns for stocks and bonds are at their expected rates of return. You IRA portfolio is growing a bit faster since you are taking out a bit less. As I mention in this post, the doubling can be a problem for a rare few retirees.

Conclusion: The IRS has proposed changes to RMD percentages. RMD percentages will be lower starting in 2021. The percentage changes are a fraction of a percent. You have a small gain in lower taxes now. That’s nice, but it’s not monumental. The other changes are small: you have a bit more in your IRA to grow tax-free; you are progressing a little faster to the time you will see your RMD double if returns for stocks and bonds are at expected rates. That doubling could possibly be a headache for some folks.

* The IRS has a different Table – with higher RMD Factors – if your spouse is at least 11 years younger.