Do we need to change our spending habits when we are retired?

Posted on July 12, 2019

Patti and I have slowly changed our spending habits, but the change was not in the way that you might think. We slowly changed to be more tolerant of spending that gives one or both of us pleasure. We no longer are bugged by the relatively small amounts the other spends on things they enjoy. That’s primarily stemmed from the process of truly trusting our annual Safe Spending Amount (SSA). [See Chapters 2 and 12, Nest Egg Care (NEC).] It also helps, obviously, that our paychecks – the monthly deposits into our checking account that add to our total SSA –are 20% more in real spending power now than they were in 2015. This post explains the evolution of our attitudes about spending money.

== $20. Decades ago. ==

Patti’s spending habits could be described as frugal. She could treat nickels as if they were manhole covers. This spending habit comes from her Mom, in particular, and was passed on in spades to her three daughters. Two sons missed out on this gene.

Years ago Patti’s habit was to ask if she could spend $20. We both remember the location and instance of this conversation. Patti, “I like this sweater. It is on sale for $20. (You can tell that was decades ago.) Is it okay if I buy it?” Tom, “Yes, but please don’t ask me for permission to spend $20. You can spend $20 all you want. $20 purchases will not have a meaningful effect on our finances now or in the future.”

That was a turning point for Patti. I think it was important, though, that I kept reminding her, “We’re just fine financially. Don’t sweat the small stuff.”

== About five years ago ==

Once I was retired, however, I became annoyed at Patti’s purchases. The $20 amount climbed to perhaps $60. That’s probably not far off from $20 adjusted for inflation, but the number of purchases and packages arriving on our doorstep started to bug me. It’s a lot easier now for Patti to spend $60. She can buy with a few clicks on the computer.

My annoyance also had something to do with not being totally certain as to what was safe to spend. I knew we had been good savers and investors for decades, and I always thought we had enough for retirement. But I never was sure that this was true or how to translate what we had to an amount that was safe to spend so we’d never run out. I was not comfortable in saying, “We’re fine financially. Don’t sweat the small stuff.”

== The shoes. The room at the Awahnee. ==

Two annoyances bubbled up to the surface. One for me and one for her at about the same time. I was annoyed at another pair of shoes purchased on sale from Little’s in Squirrel Hill or the FedEx delivery to our front door from Cole Hahn. I would nip at her, “Not ANOTHER pair of shoes! You don’t NEED another pair of shoes. When will this stop?”

Patti also was annoyed with me. We were planning a visit to Yosemite. I found three options in the valley. For the dates we wanted, one was not available. One that was available was $280 per night and the spectacular Ahwanee Lodge was $500 per night. Of course, I went for the Ahwanee for $220 more per night. I booked it and charged one night as a deposit to our credit card. Oh, did that raise eyebrows when she saw that on next month’s statement! “This is for just ONE NIGHT at Yosemite?”

== Now that we know ==

We got over those bumps after I calculated our Safe Spending Rate (SSR%). (See Part 1 Nest Egg Care.) Our SSR% was more than the general Rules of Thumb I had in my head. And I didn’t trust the general Rules: they provided no details as to how their Rules were calculated. I trust our SSR% because I know the details, and I hope from Chapters 2, 3 and 4 you will trust yours.

We first started paying ourselves our Safe Spending Amount (SSA) in 2015 directly to our checking account each month. Paying ourselves is a big psychological edge. I do not decide that we NEED to withdraw more money for our checking account. The paycheck just arrives like clockwork. It’s the third monthly paycheck directly deposited into our checking account – we each get a direct deposit from Social Security. We get these three paychecks even though we don’t show up for work!

With the mobile banking app from PNC, I can see our checkbook balance at any time. We always have a large checking account balance. I like it sloppy. It’s silly to worry about $60 purchases now and then or even the infrequent $500 purchases.

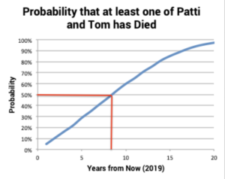

By going through the process in NEC, Chapter 3, this has also sunk in: we don’t have that many years left together. It’s not pleasant to look at our probabilities of living: I can calculate that it’s 50% probable that one of us will have die in fewer than nine years (end of 2028). We’re both in excellent health, and we feel like we will beat those odds, but the odds are fact. Lesson: if it gives us a tiny bit of joy, just forget the amount spent. Don’t sweat details.

I’m very tolerant of Patti’s purchases. As I mentioned in this post, Patti gets a real shot of joy when those shoes arrive. Here was the delivery today: not shoes! “These Athleta pants just fit great. They cost $99, but they were on sale for $39.99. I had a $40 reward credit, so these didn’t cost anything. I still have a penny credit.” Tom, “Great. I like the design. You needed another pair. You’ve got a lot of work to do to catch up with Alice in the variety of exercise pants you wear.”

Patti now pitches in to spend more for a better room. We get a much better room when we travel for a lot less than the $220 for the Ahwanee. I just looked over our bills for our May trip to the Lake District in England. I made the reservations for 12 nights. Patti made them for two. All were the best room, in my opinion, that each place offered. I calculate that we averaged $42 more per night than the lowest priced room of the four places we stayed. We really like the places we stay and the rooms were terrific. That’s $42 for added joy each day on the trip: peanuts at this stage in our lives.

Lessons:

1. Assuming there are two of you, one of you has to have a clear grasp of the three key decisions that lock in the number of years you have with zero chance of depleting your portfolio. That person has to clearly understand the underpinnings of your annual Safe Spending Amount. That person has to grow to absolutely trust that amount.

2. That person needs to state your financial retirement plan in simple terms. Maybe state it often so the two of you are on board. “If we don’t spend more than $xxx per year, we just can’t run out of money. I can remind you of the details if you like. We’re doing just fine this year. Let’s not sweat the small stuff.”

3. Pay your annual SSA as monthly paychecks. That paycheck will arrive as reliably as your Social Security payments. Seeing the total each month makes your annual spending budget much clearer. You shift your thinking from “What do I need to withdraw for our spending?” to “How are we going to enjoy this money that keeps rolling in?”

4. Recognize that the sands of time are running. Depending on your age, you can’t count on that many more years, especially that many healthy years. A probability of living calculator helps you see this. If something gives you a shot of joy, go for it.

5. My guess is that the things that give you shots of joy throughout the year don’t cost that much. I particularly like staying in a better place and room when we are on vacation. (Patti has grown to like that, too.) Patti gets shots of joy from the new shoes, blouses, pants, or dresses purchased at a deep sale price. (I get pleasure from her enthusiasm when she tells me about her latest bargain.) And to be honest, she saves far more on airfares – almost a passion for her – than she spends on those things.