Category Archives: Uncategorized

Do you have check writing for your retirement account?

If you are over 70½ you want to make contributions from your retirement accounts using QCD – Qualified Charitable Distributions. I wrote about this a year ago. You get the full tax benefit of donations when you make them from your retirement account. You

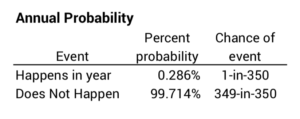

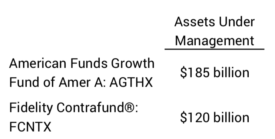

How does the second largest actively-managed fund – Fidelity Contrafund (FCNTX) – rank against its peers?

This post puts the second largest actively managed mutual fund – Fidelity® Contrafund® (FCNTX) – in the same barrel that I put American Funds Growth Fund of America (AGTHX) in two weeks ago. How well has FCNTX performed over the

Is it time to get a mortgage or refinance your current mortgage?

Is this a crazy question to ask someone who is retired or nearly retired? No! Mortgage rates now are low, low, low. The average 30-year mortgage now is about 3.7%. I summarize data from this graph that shows rates are within .4% of their lowest

Have we reached the tipping point for the demise of actively managed funds?

This article states that in July the amount invested in passive index funds passed the amount invested in actively managed funds: roughly $4.2 trillion each. The first Index Fund started in 1976. That means it took 43 years for Index Funds to win 50% share