Category Archives: Uncategorized

Is Rental Property a good income generator for you?

I read this article that suggests Rental Real Estate is a good investment for retirees. I hate even thinking about investing in rental real estate. Or why I’d hold onto it if I had it at this stage in life. This post discusses why I

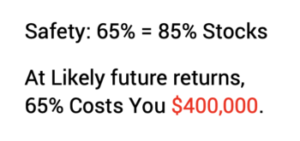

Will your heirs get $thousands less from your inherited IRA?

A possible change in tax law would require heirs of our IRA to fully distribute them over fewer years. The change, described here, (“… It Could cost Your Kids Thousands.”) would require that our IRAs be fully distributed within ten years of our death.

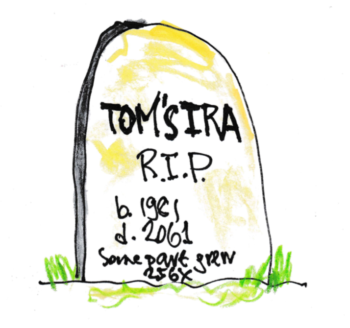

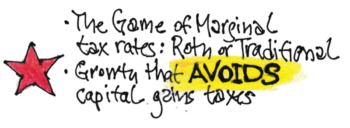

How many decades will your IRA enjoy tax-free growth?

A possible change in tax law would cut the number years our IRAs that we leave to our children or other heirs will grow tax free. The change, described here, would require that our IRAs be fully distributed within ten years of our death.