Are you rich? Where do you rank in income and net worth?

Posted on August 30, 2019

These two articles (here and here) in the New York Times were helpful in giving me an idea of where Patti and I rank in income and net worth. The purpose of this post is to give a bit of explanation and to suggest you use the two links to get an idea of where you stand. In the final analysis, however, I don’t really care where we rank. Patti and I are happy campers: we know what’s safe to pay ourselves from our nest egg. It’s enough. We aren’t – and won’t be – constrained from doing the things we both enjoy for the limited number of years we have left. That makes us rich.

== Income rank ==

The worksheet “Are you Rich? This Income-Rank Quiz Might Change How You See Yourself” shows where you rank by income for your age. I didn’t find the results that helpful. There are too many variables to make this useful for someone who is retired. Commenters to this article went nuts. “You say I’m rich for my age, but I have enormous college debt. I don’t at all feel rich.”

We retirees largely decide what to pay ourselves from our nest egg. For those of us with a nest egg, this pay is going to be the largest part of our income. (Those of us over age 70½ must take pay – RMD – from our retirement accounts.) Patti and I choose to pay ourselves our calculated, annual Safe Spending Amount (SSA) (See Chapter 2, Nest Egg Care.), and SSA will always be greater than RMD. So, we may just have greater income than retirees who pay themselves too little, because they have no idea of what’s safe to pay themselves.

I also don’t find it useful to understand how we rank among “earners in your area”. From this table below, Pittsburgh – our home – ranks low in income relative to other areas and also ranks low to others in cost of living. Cincinnati is close in cost of living, but this table would tell me that there are more folks there with money than here. I don’t know what to conclude from this.

== Net Worth Rank ==

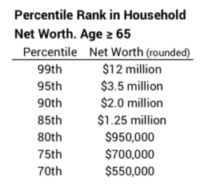

I find this worksheet more useful, “Are You Rich? Where Does Your Net Worth Rank in America?” You can find your approximate rank in national net worth – the value of your financial assets plus your equity in your house. I’d guess that this excludes a calculation of the value of Social Security and of defined benefit plans.

I was mystified at first at the graph, “How income and wealth diverge across age.” The graph shows folks +65 and older at the 90th percentile have net worth of about $2.1 million in net worth and income of about $165,000.

That makes income a shocking 8% of net worth. Even when I guess the equity value of their home and the part of the $165,000 income that is Social Security, I calculate that the slice of income that comes from their financial nest egg is a far higher rate than one would derive from Nest Egg Care. Somebody age 65, for example, should have an SSR% of about 4%. This says retired folks are spending too much of their nest egg each year! I hope to heck that is not you! The only other explanation is that most of these folks continue to work or have other significant sources of outside income.

== $1 million for those over 65 is not rich ==

The article implies that “Rich” is in the 90th percentile – about $2 million net worth – and someone or a household headed by someone with a net worth of $1 million is roughly at the 80th percentile.

I’d agree than $1 million just isn’t what it used to be. We likely had that number planted in our head decades ago. Inflation has taken its toll. Patti and I started out on our plan for spending in 2015 at an SSR% of 4.40% – $44,000 per $1 million. Perhaps $1 million net worth is $800,000 financial assets and $200,000 non-financial assets – equity in your home. You can only pay yourself from your financial assets. $800,000 of financial assets would work out to be less than $35,000 Safe Spending Amount. Adding in Social Security might make annual income $70,000. That’s below the 75th percentile of income. That’s better than most folks but would be about 60% of that “rich” level of income in the previous worksheet.

== Investing in stocks makes a big difference ==

The text makes the case that folks over age 65 who had the capacity and discipline to invest in stocks are far better off than those without the capacity or who chose not to save and invest in stocks.

The primary asset of the rich is stocks. That’s an asset that grows at about 7% real return per year. The primary asset of those at the median or below is their house. That’s an asset that might grow at 1% per year. Those who saved and invested in stocks outdistance those who didn’t.

And those with net worth stored in Stocks have money they can spend. Those with net worth stored in their home don’t.

== The ultimate Test ==

The ultimate test of where Patti and I stand – our happiness rank – is based on knowing that we can pay ourselves enough from our nest egg. We are rich in the sense that we do not feel constrained in what we want do to Enjoy the relatively few years we have left. This happiness is unrelated to exactly where we stand relative to anyone else.

And we’re happier than before because we have more to spend than we did at the start of our plan. That’s the result of our annual Recalculation.

I think most retired folks are not as happy about their financial situation largely because they have NO IDEA what is safe to spend. They don’t know if they have enough. With the exception of the few at the very top in net worth, they think they will never have enough. They want more. They’re driven to build an even bigger next egg and spend too little to help do that. That’s not a good retirement plan and that’s not happiness to me.

Conclusion. Two worksheets in the New York Times give you an idea of where you rank in income and net worth. That’s nice information but does not really get us retirees to what we want to know: what’s safe to spend from our nest egg and is it enough that we can enjoy our remaining years. Patti and I got that answer by going through the steps in Nest Egg Care. That’s the only way I know that you can get there with confidence.