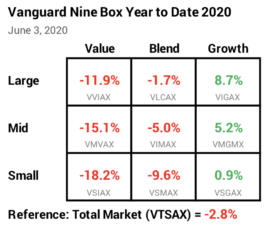

Is it time to sell stocks?

OMG. This article says 33% of investors over age 65 sold ALL their stocks this year! (This may have been FALSE NEWS*.) This is about the worst idea ever. Surely you didn’t do this. What does this tell us nest eggers? Those folks have NO