Could mortgage rates be any lower?

Posted on May 29, 2020

Mortgage rates are now the lowest in history – or at least for the last 100 years. This site says the average rate on a 30-year mortgage is 3.15%, and you can get a rate lower than this. This fall I refinanced our mortgage at a stated rate of 3.625%, and I just pulled the trigger on Thursday to refinance the mortgage balance at a stated rate of 2.99%. I don’t think it will ever drop enough to consider refinancing ever again. If you have a mortgage, this is the time to refinance. If you think you have too much tied up in non-financial assets that you may want to convert to financial assets, this is the time to get a mortgage. The purpose of this post is to describe steps I took to refinance; they’d be the same if you want a mortgage.

== Recent history and 3.625% ==

I most recently refinanced in October, just six months ago, and now I’m doing it again. My purpose of refinancing then was to convert some of our net worth trapped in our non-financial asset – our home – to get more into financial assets: money that we can spend, give away or keep in a bigger emergency reserve. That equity in our home is almost a dead asset; I can’t use it until I figure out how to turn it into cash; in fact, it just consumes more and more of our financial assets over time.

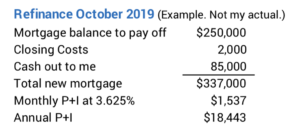

I refinanced this fall at 3.625% and received about $85,000 in cash a day or so after closing. I view the 3.625% I pay on that as cheap relative to the option of having to pay 22% marginal tax to get that same added amount into our taxable account.

== Now 2.99% ==

In September I refinanced through one of the lenders listed with Costco, NBKC. I got a big break on the closing costs by being an Executive Member at Costco.

Thursday I went to the Costco site and clicked to get bids from NBKC and one other listed as having the lowest rates. Both responded within hours. We talked (Our prior loan officer at NBKC was our point of contact there.), and they both sent me a quote about 30 minutes later. The proposals were within spitting distance of each other, so I stuck with NBKC. I called our loan officer back and locked in on the stated rate, 2.99%. All done in less than four hours. I’ll get the official proposal today, Friday.

Paperwork that I had to submit the last time was straightforward. I have the file folder of what I sent, but I’m guessing our NBKC loan officer may be able to pull it all from the file he has for us from October. I’m sure he’d like a 2019 tax return, but I don’t have that to send him. I’m missing one tax reporting statement – a K-1 due from a local accounting firm – and I can’t totally complete it.

== Next steps ==

I’ll submit whatever they need, but I will likely have to wait 45 to 60 days for everything to be complete and to start paying the new mortgage. It will be longer than normal. After the close of the mortgage in early November I obtained a HELOC – Home Equity Line of Credit – from my bank, PNC. Getting the HELOC approved was much more time consuming than the much bigger first mortgage with NBKC. PNC now has to re-subordinate their HELOC to the new mortgage. I can imagine PNC isn’t going to be quick in doing their thing. They’ll also charge me a couple of $100 to re-subordinate.

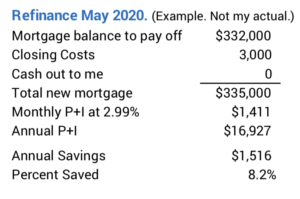

== 8% Lower P+I = $1,500 per year ==

I’ve paid off some principal on our current mortgage. After I’ve paid that off and rolled our closing costs into a new mortgage, I’ve lowered our monthly payments by about 8%. That’s more than $1,500 per year. Since I rolled the closing costs into the new mortgage, the final proceeds from the sale of our home will be less, relative to our current mortgage, by those added costs. That amount is small potatoes relative to the $1,500 less we’ll pay per year in principal + interest.

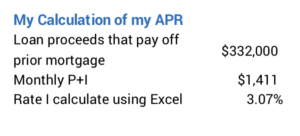

== We really don’t pay 2.99% ==

Our proposal quotes a stated rate of 2.99%; that’s the rate I pay on the total mortgage. And it states an APR – annual percentage rate – of 3.027% for the option I picked; that includes the effect of closing costs. I calculate my APR is slightly higher – 3.07%. I’m not sure why there is a difference.

Conclusion: It was a very good time to consider refinancing our mortgage last fall, and Patti and I did that in October. Mortgage rates now are at an all-time low, and on Thursday I pulled the trigger to refinance at a stated rate that was about .6 percentage points lower than the rate I obtained last October. Our principal + interest payments are about 8% less than we have been paying. That works out about $1,500 per year for us. This is a simple process: go for it if you have a mortgage and want to lower payments or think you have too much sunk into your big non-financial asset: your home.