Is it time to sell stocks?

Posted on July 17, 2020

OMG. This article says 33% of investors over age 65 sold ALL their stocks this year! (This may have been FALSE NEWS*.) This is about the worst idea ever. Surely you didn’t do this. What does this tell us nest eggers? Those folks have NO financial retirement plan. They see the market variations as a roller coaster: that’s going to be a very emotional ride. We nest eggers see our financial retirement plan as a hockey stick. Our brains focus on the point that we’re worried about: the shaft length of our hockey stick. That’s the point that we’ve LOCKED IN that’s many years and perhaps decades away. It translates to many years of ZERO CHANCE of not being able to take a full withdrawal for our spending. But all this aside, I sold stocks this week! The purpose of this post is to explain why I sold stocks now.

[*This article states the original article in the WSJ was in error. This later WSJ article (behind paywall) implies the same.]

== A farmer pre-selling his crop ==

I’m thinking like a farmer. He plants his corn and soybean crops in May. He will harvest both in October and November but sell them in late November and December. He has a choice: do I just wait until late November or December and sell at the spot price for one or both of them, or should I enter into a contract or contracts now that guarantee a price per bushel for each – typically close to today’s spot price?

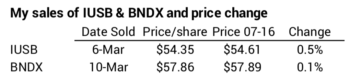

This is the same thinking that I used when I decided to sell bonds, my soybeans. I sold March 6 and again on March 10. I sold enough IUSB and BNDX so that I would not have to sell ANY stocks at our usual time to harvest – the first week of December for our spending for the upcoming year. The table shows my sales and prices as compared to the prices today.

I could judge that I’m behind in the game. I’ve “lost” a bit – perhaps 0.5% or a bit more since I’m not including some dividends that would have reinvested. Prices may be higher or lower in early December. The decision to lock in a price now may look good (Prices in December turn out to be lower.) or not so good (Prices in December turn out to be higher.). Just like the farmer, I’ll ignore the comparison and be happy that I prudently reduced risk.

== Portfolio return for 12 months ending Nov 30? ==

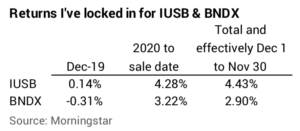

I’ve basically locked in the returns for for bonds for our calculation year – the 12 month period ending November 30. I use those 12-month returns to calculate our Safe Spending Amount (See Chapters 2 and 9, Nest Egg Care) for the upcoming year. At current money market returns – basically 0% – I won’t need to adjust these for our 12-month return.

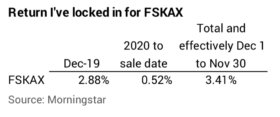

I didn’t apply the same thinking in March to stocks, my corn crop. Stocks rolled off the cliff in late February and bonds kept improving to their all-time high in early March – now surpassed. But I applied that same thinking on Wednesday. I sold enough of FSKAX to roughly equal what I would normally sell in December for our spending in 2021. My return for FSKAX since December 1 is about +3.5%. Again, that would be the total through November 30.

I chose not to sell any VXUS. That looks a little silly as I now see it’s only off -2.3%. I can calculate our total portfolio return for our year ending November 30 had I sold VXUS and locked in its -2.3% return. The +2% total return will likely justify a real increase in our SSA for 2021 – an increase greater than an inflation adjustment. (This depends on the final number for inflation; the annual rate of inflation is roughly .5% now.)

I’ll keep scratching my head about why I wouldn’t want to sell VXUS now. I think my inaction now is a common financial-behavioral flaw: I don’t want to sell when I’d sell at a price that my brain says is a loss relative to some arbitrary point in the past.

== I may never pre-sell again ==

Every year a farmer makes the decision of whether or not to pre-sell some of his fall crop to avoid uncertainty in the December spot price. My plan has been to always sell at the spot price in the first days of each December. I do get a little antsy every November. But I figure that over many years I’ll even out short-term swings in prices from, say, early November to when I sell in December. That’s what I’ve done for the first five years of our plan. This is a very unusual time for sure, and this is the first time I’ve even thought about pre-selling. I think – I hope – that this will be a rare event.

Conclusion: We nest eggers have a solid financial retirement plan. We are far less concerned about the vagaries of the stock market. Those retirees with no plan see the roller coaster and tend to panic: an article stated that 33% of all retirees sold ALL their stocks this year. (Some other articles suggest this was overstated.) If you’re a nest egger, you have a plan and you didn’t come close to doing that. I judged this week, however, that it was prudent to sell stocks that I would normally be selling the first week of December. I decided I would be happy to receive today’s price then, so it made sense just to lock that price in.