Are you the Master of your Hockey Stick?

Posted on July 3, 2020

My friend Dan sent Patti and me an invitation (Hey, real mail!) and underneath our names in the address it said, “The Hockey Stick Masters.” I laughed. Dan knows I have our hockey stick imprinted in my brain. He’s seen my orange painted hockey stick. I look back over the past year or so, and see that I have not written any reminders to reinforce the Hockey Stick in our brains. This purpose of this post is to tell you how to SQUASH RISK in your financial retirement plan. It’s all about LOCKING IN the shape of your Hockey Stick. Do that, and you are the Master of your Hockey stick.

== Financial risk of your retirement plan ==

The Hockey Stick is a picture of the financial risk of your retirement plan. It’s taken from the graph of the year-by year risk or chance that your portfolio isn’t healthy enough to allow you to take a full annual withdrawal for your spending. The shaft length is the number of years with ZERO CHANCE of failing to be able to take a full withdrawal. Thereafter, the blade angle represents increasing chances that you can’t take a full withdrawal.

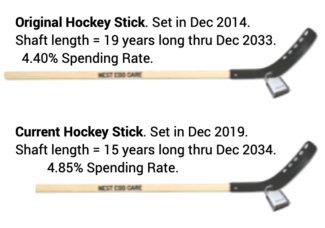

Patti and I started with a stick with shaft length of 19 years. The stick we use now is shorter with a greater Safe Spending Rate (SSR%; See Chapter 2, Nest Egg Care). The calculations told us we could use that shorter stick now that we’re older. That means have ZERO concern about the amount we can spend every year through December 2034. I’d turn 90 within a month.

== It’s the correct picture of risk ==

The Hockey Stick is the correct picture of financial risk in my view. You want to control how long your money will last. My friend Steve shouts, “DON’T RUN OUT OF MONEY.” That’s the risk you want to avoid. I say that a bit differently, “DON’T DEPLETE YOUR FINANCIAL PORTFOLIO.” I say that because most all of us exclude a big non-financial asset from our retirement plan. That’s the equity in our home that we could tap if we needed to or wanted to. (See Chapter 1, Nest Egg Care.)

If you control the years for ZERO CHANCE of depleting your portfolio, you’ve beaten financial risk to a pulp. You can do this.

The financial industry doesn’t like the that image of a Hockey Stick. They want you to think about risk as a Roller Coaster – the ups and downs of the market and of your portfolio. They want you to decide that you need to hire them to smooth the ups and downs in your portfolio. And they want you to think that’s a complex task. You gotta own LOTS of securities. It’s better for them if you think that way: more worry means you’re less inclined to take a safe, healthy, annual withdrawal to ENJOY in retirement. You take less; they manage more; they earn more fees.

Here’s what I think you need to do to be a Master of your Hockey Stick. It’s a simple checklist.

• Keep that image of the Hockey Stick in your brain as the financial risk for your portfolio. Wipe the roller coaster out of your brain. That should not be your picture of financial risk. You have NO control over the ups and downs. Don’t think you should try to control them.

• Understand that YOU TOTALLY CONTROL the shaft length of your stick. You LOCK IN shaft length at the start of your plan. That’s the number of years you want for ZERO CHANCE of depleting your portfolio.

You can be assured the math that determines the shape of the stick is correct, because it uses a planning trick. The calculations ALWAYS assume you will face the MOST HORRIBLE sequence of stock and bond returns in history. Believe me: that most horrible is MOST HORRIBLE. And I independently verified that the math that calculates the shaft length and blade angle of a Hockey Stick is correct.

• Make just two key decisions that LOCK IN the shaft length of your stick. There’s a third. You’re a master when you make these three decisions, write them down, and stick with them year after year. You wind up with a very dull, unchanging, and highly effective portfolio.

== 19 years ==

Let’s make the assumption that 19 years is your choice for the number of years you want as ZERO CHANCE for depletion. You want to LOCK IN 19. That was the shaft length Patti and I decided on for our plan that started on January 1, 2015. You can read about our logic on that choice in Chapter 3, NEC.

== TWO (basically) LOCK IT IN ==

How do you LOCK IN 19 years? You make two key decisions.

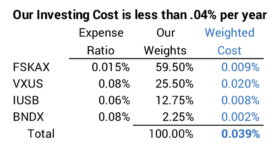

• Decide to invest at rock-bottom cost. This a fundamental and simple starting point. You can only reliably be low cost – or reliably keep most all that the market gives – by investing in index funds. I targeted no more than 0.1% weighted average Expense Ratio for our plan. (See Chapter 6 and Appendix B, NEC.) I picked four funds/ETFs at the start of our plan. We’ll stick with those four for the rest of our lives.

Over the past five years the Expense Ratio of several of the four has declined, and Patti and I now pay less than .04% per year. That’s down from about .07% five years ago. That’s less than $40 per $100,000 portfolio value or less than $400 per $1 million invested.

Most retirees totally overlook the importance of investing costs. The financial industry loves this, of course. The typical retiree pays 20 times what we pay and adds uncertainty to the net they get to keep out of total market returns. That flaw means they can’t really LOCK IN the shape of their stick. (High costs also BADLY hurt how much they’ll have when returns aren’t MOST HORRIBLE.) Masters of the Hockey Stick know to NEVER MAKE DECISIONS THAT ADD UNCERTAINTY to the shape of your Hockey Stick.

• Pick a spending rate that gives you the shaft length you want. This should be obvious: when you withdraw less for your spending, your portfolio will last longer – the shaft length is longer. When you spend more, the shaft length is shorter.

You can calculate the spending rate for 19 years in this example after you’ve committed to low, low investing cost. That was 4.40% ($44,000 per $1 million portfolio) for Patti and me the start of our plan: we withdrew that amount – adjusting for the size of our portfolio relative to $1 million – for our spending in 2015. (See Chapter 2, NEC.)

The good news is that as we age, we’ll most likely be able to play our game with a shorter hockey stick, one that has a greater spending rate. That’s why Patti and I now play the game with a $48,500 Hockey Stick and not the $44,000 one we started with.

• Finally, you decide on your mix of stocks vs. bonds and stick with that decision over the years. This decision has a lot less to do with the shaft length of your hockey stick and more to do with than amount of money you will have in future years if your portfolio return is not on the track of MOST HORRIBLE. I envision a pile of money next to my stick. How big might that pile of money be in the future? You want to maximize that pile after you’ve LOCKED IN the shape of your hockey stick.

Your decision on the mix of stocks also has to do with your ability to shift your thinking and emotions from the Roller Coaster to the Hockey Stick. Folks who stick with the Roller Coaster wind up with far too low mix of stocks. They think of bonds, for example, as a means to smooth the ups and downs. Masters of the Hockey Stick know that bonds are insurance: sell more bonds when stock are down to buy time for them to recover. Masters of the Hockey stick have a greater mix of stocks than those who look obsess about the Roller Coaster.

Most folks I know start their plan at 75% mix of stocks. I’m fine with that. But less than that just does not make math mathematical sense. (See Chapter 8, NEC.) After a few years at 75%, most folks get more comfortable and move toward the 85% mix of stocks that Patti and I have.

It sounds strange, but 85% mix of stocks is NO LESS RISK than 75% mix of stock, but that’s because Patti and I RIGIDLY maintain a Reserve, which means we can delay having to sells stocks for a long time. We RIGIDLY stick with our Safe Spending Amount based on that mix: we won’t spend one dime more. We have really low investing cost: we get to keep almost all that the market will give.

Conclusion: It is surprisingly straightforward to squash financial risk in your retirement plan. We want to squash the risk of depleting our portfolio to the point where we can’t take a healthy withdrawal for our annual spending. A plot of the year-by-year chance of depleting our portfolio looks like a Hockey Stick. The shaft is the years of ZERO CHANCE of depleting. This is a different view of risk: risk is not the Roller Coaster of daily, weekly, or annual changes to our portfolio value. You can be a Master of your Hockey Stick. Firmly implant that image in your brain; forget the roller coaster. Lock in the years with NO CHANCE with just two key decisions. 1) You MUST be a low-cost investor. 2) Withdraw an annual Safe Spending Amount each year; you can spend (or gift) it ALL, but you can’t spend one dime more.