Tom’s Blog

Why will Social Security (SS) increase by 3.2% when inflation was 3.7%?

I’m sure you saw this news this week: SS benefits will increase by 3.2% for 2024. At the same time, the news was that 12-month inflation was 3.7%. Why the difference? This post is a refresher: SS uses a different measure of inflation than

Do institutional fund managers outperform mutual fund managers?

A SPIVA report that I summarize in this post shows that nearly 90% of institutional fund managers return less to the owners of their fund than their benchmark index over 10 years. I recently summarized a prior SPIVA report on active mutual fund managers:

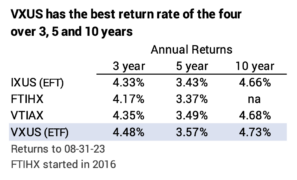

How closely do International Stocks Funds mirror the index they attempt to mimic?

My post two weeks ago addressed US funds. This post looks how closely four international stock index funds match the benchmark they are attempting to match. Two Vanguard funds very closely track their benchmark index. Two other funds don’t do as well. The return rates