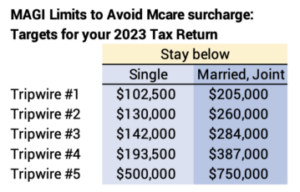

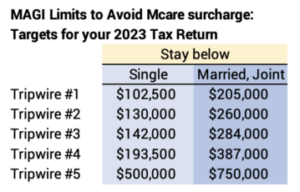

You now have your target for 2023 MAGI to avoid a Medicare surcharge (IRMAA).

Posted on September 29, 2023

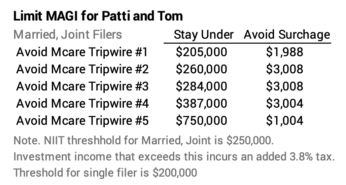

We now know the tripwires of income that trigger surcharges we retirees could pay to Medicare in 2024. About 15% of those on Medicare have high enough income to result in surcharges. If you are in that category now or might be in the future, you want to use the tripwires formally announced this year to plan your MAGI – modified adjusted gross income – on your 2023 tax return. You don’t want to unnecessarily cross a tripwire. The cost is roughly $1,000 or maybe $1,500 per taxpayer. Ouch.

The details:

== Medicare Parts B+D ==

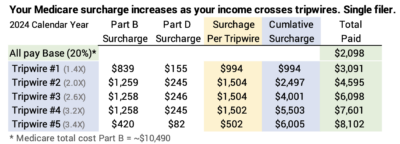

For 2024, Medicare calculates ~$10,490 per person as its total cost of “Part B” coverage – the cost of physician services, testing, hospitalization, and other. It calculated its cost for “Part D,” which helps to lower your drug costs.

All of us pay Medicare 20% of the estimated cost for Part B coverage. None of us pay a base amount to Medicare for Part D. Most of us see our payments to Medicare as a reduction in monthly Social Security benefits. The standard payment for Part B this coming year will be about $175 per month – about $2,100 per year. That’s about $10 per month or 6% more than the amount we are paying in 2023.

== IRMAA surcharge ==

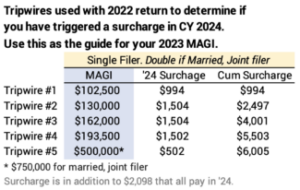

IRMAA = Income Related Monthly Adjustment Amount. It’s the surcharge – an added tax – you pay back to Medicare if your income crosses a tripwire or threshold. I show the calculation of surcharges for calendar 2024 for the five tripwires. The first tripwire costs a single filer about $1,000. The next three cost about $1,500. The total for all five costs about $6,000 per taxpayer. Double those amounts if you file a married, joint return.

== MAGI triggers your surcharge ==

Your MAGI, Modified Adjusted Gross Income, determines if you’ve crossed a tripwire and pay a surcharge. The greater your MAGI, the more tripwires you cross. MAGI for most of us is all taxable income + interest not federally taxed. The triggers adjust for inflation each year unless Congress overrides the adjustment; it’s overridden in about half of the last 15 years.

== The two-year lag ==

The tripwires announced now use the MAGI from your 2022 return that you filed this past April to determine if you pay a surcharge in 2024.

You will file your 2023 return by April 2024, and that MAGI will be used with the tripwires issued a year from now to determine if you will pay surcharges in 2025.

Use the current tripwires to plan your MAGI on your 2023 tax return. I would not plan assuming an inflation adjustment to the tripwires next year; if there is one, I think it will be small.

== Why this is important? ==

We need to pay attention to – plan – our MAGI each year. We also need to think about future years, because our MAGI increases in real terms for many years in retirement. We all should expect to get closer and closer to a tripwire over time. That’s because RMD becomes a growing part of our total income. At expected return rates for stocks and bonds, RMD will double in real spending power from the value at age 72.

Why? Our retirement portfolio grows in real spending power because the RMD% that we withdraw is less than the expected real return rate on our portfolio for at least the first ten or so years. At age 72 the RMD percent of 3.65% is about 60% the expected real return rate of 6.4% on my portfolio of 85% stocks and 15% bonds. And the RMD% roughly increases by 70% from age 72 to 85 (3.65% to 6.25%).

MAGI is of most concern to married filers: once a spouse dies, the survivor faces tripwires half the amount they were when married. Too much MAGI – out of kilter with your cash needs for spending – is not a good thing. Too much income tax paid. Too many tripwires crossed.

== Your control over your MAGI ==

I’ve discussed what I do to plan MAGI each year in early August. Patti and I have wiggle room on our MAGI. I can get the same cash for spending but at a bit lower MAGI.

We have no control over Social Security Income. We have no control of dividends from our taxable investment account. We do have some control over the taxable portion of withdrawals from our Traditional retirement account. For example, I can use QCD as part of RMD to lower taxable income and use other lower tax cost sources for our Safe Spending Amount (SSA; see Chapter 3, Nest Egg Care) or the cash we want for spending if that’s less than our SSA. Sales of securities from my Roth are 0% taxable income. Sales of taxable securities are about 6% taxable income depending on the percentage gain.

It’s a puzzle to solve each year if you are too near a tripwire. It a tougher puzzle when you project the future and want to avoid tripwires in then.

Conclusion: We know the tripwires of income that result in $1,000 or $1,500 surcharges that you pay to Medicare; double those surcharges if you are a married, joint filer. Tripwires just announced are about 6% greater than than last year. I use the current tripwires to plan our 2023 tax return: I do my best to plan our total taxable income so that I don’t cross a tripwire that I could otherwise avoid.

I can lower our taxable income – MAGI – to get under a tripwire that looks to be too close for comfort. I’ll do that by selling securities with no or low taxable income to get the cash we need for spending rather than using taxable withdrawals from our Traditional IRAs.