Have you completed your draft tax plan for 2023?

Posted on August 4, 2023

My tickler file told me that this is the week to complete my first cut on my tax plan for 2023. This post gives you a template for the spreadsheet I use. It might help you for your tax planning for this year. It’s similar to the one I provided last August.

== It’s important to plan your taxes ==

1. I plan now to estimate how much I will withhold when I take our withdrawals from our IRAs in the first week of December. I pay no estimated taxes during the year. That’s the only time I withhold: I get an interest-free loan during the first 11 months of each year.

2. With some planning you may avoid taxes that you will never have to pay.

== Two taxes I don’t want to pay ==

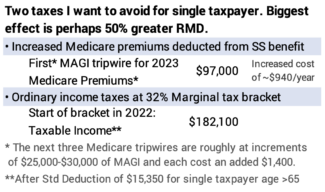

• I never want to pay Medicare Premium surcharges that I could otherwise avoid. A tripwire costs us as married, joint filers about $2,000. The tripwires will be half as far away as now when it is just one of Patti or me alive.

• Patti and I will never get close to the 32% bracket while the two of us are alive. But I need to think about this when it is just one of us alive. Greater RMDs then push toward that bracket. The start of that bracket is half of what it is for married, joint filers.

== Our 2023 tax return ==

I start with our Safe Spending Amount (SSA) for 2024. I calcuate that right after my 12-month year ends November 30. I plan to sell the first week of December to our SSA for 2024 into money market. I’ll then use autopay it out to our checking account throughout 2024.

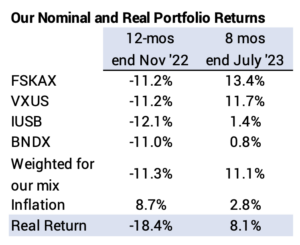

• Our SSA will be the same real amount as last year. I’ll assume now that last year’s SSA adjusts for 4% inflation. The Social Security COLA increase that will be announced in October will be close to this. Our portfolio return is good so far this year (my calculation includes a very poor December 2022), but the return isn’t close to the level that means I’d calculate to a real increase in our SSA.

• Our RMD this year is less than last year. Our year-end 2022 portfolio value was about 20% less than year end 2021. That means I will get more of our SSA from greater sales of taxable securities for than last year. Taxable income and gains taxes are a much lower bite out of the total.

• I had a wrinkle this year. I usually sell in the first few days of December to get our SSA into cash for the upcoming year. I didn’t do that last December, since I decided to sell only bonds for our spending in 2024 and sell throughout the year. That didn’t have any real effect on this tax return: bonds had declined so much that I wouldn’t have had taxable gains to report last year, and I won’t repory any by selling this year. Bonds have gained about 3% since last December, so I came out just a little ahead by selling them throughout 2024 rather than then.

• Our estimated Adjusted Gross Income won’t be close to a Medicare Tripwire that we could otherwise avoid. I don’t have to consider selling from my Roth to lower AGI. I will keep that powder dry.

== A future tax return ==

I’m trying to capture what Patti’s tax return will look like when I’m no longer around. I adjust my estimated 2023 tax return for a single tax payer, lower Social Security benefits, and greater RMD – we’re older and I use 50% greater RMD; if you are younger, you should probably look at double RMD. (Read here or here if you are unclear as to why your RMD may double.)

I did that. I have decided not to consider actions now to avoid those two taxes that I hate. I have taken actions in the past. These are the three I have considered. The earlier I do them, the better.

1) Convert traditional IRA to Roth. It makes sense to pay tax now – say at 22% marginal tax – if that avoids a much greater tax – say 32% marginal tax in the future. You keep 13% less at the 32% rate than you do at the 22% rate. Roth also buys you flexibility to avoid Medicare premium surcharges that you could otherwise avoid.

2) Donate from more from IRAs: greater QCD donations. If you give a set amount, shift to give more earlier and less later. This the effect of lowering future RMDs.

3) Withdraw more from traditional IRAs and give the net to heirs for contributions to their IRAs. The effect for you plus them is, basically, no taxes paid. You pay tax but they, in effect, get a tax deduction. The net is zero tax if the marginal tax brackets are the same.

Conclusion. I complete a draft plan for taxes the first week of August. I start this year with my estimate of our Safe Spending Amount (SSA) for 2024. I figure out where I will sell securities to get it, and I estimate total taxes we have yet to pay on our 2023 return. I’ll withhold those taxes when I withdraw from our IRAs the first week of December.

I also do this tax planning to make sure we never cross a level of Adjusted Gross Income that triggers a Medicare premium tripwire that I could otherwise avoid.

I also have to think about a future tax return for a single tax payer – likely Patti’s return when I’m no longer around. RMDs could be 50% greater than now. Medicare premium tripwires and marginal tax brackets start at half of what they are for us as married, joint filers.