How closely do International Stocks Funds mirror the index they attempt to mimic?

Posted on September 22, 2023

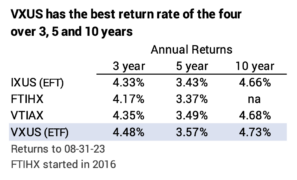

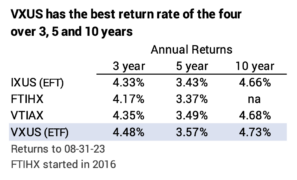

My post two weeks ago addressed US funds. This post looks how closely four international stock index funds match the benchmark they are attempting to match. Two Vanguard funds very closely track their benchmark index. Two other funds don’t do as well. The return rates for these funds are very similar: over ten years, the best returned about $10 per year more per year relative to the worst per $10,000 initial investment. The best return rate over the last three, five and ten years has been VXUS, the Vanguard Total International Stock ETF.

Details:

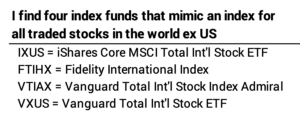

I only find four funds that are Total International Stock funds that attempt to match an index for all international stocks in the world: 24 developed countries; 22 emerging economies; large, mid, and small cap stocks. The universe is about 16,000 stocks.

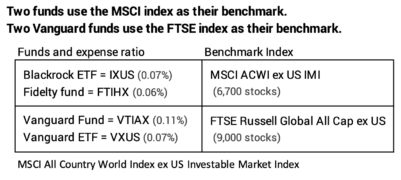

The funds aim at two different benchmarks. Neither has all 16,000 stocks in its index. The MSCI Index holds 6,700 stocks. The FTSE index holds about 9,000 stocks. Both represent 99% of the value of all international stocks.

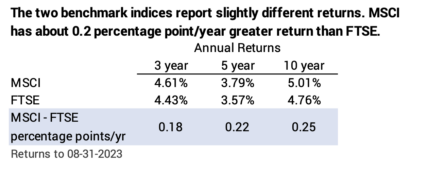

The two benchmarks show different returns. Returns for the MSCI index are greater than those for the FTSE index. On this basis, I would expect Blackrock and Fidelity to have higher returns than the two Vanguard funds.

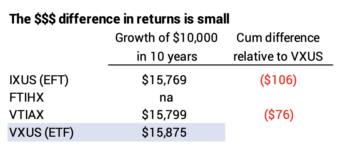

The highest returns, however, are from the two Vanguard funds. The dollar return differences among the four are small about $10 per year per $10,000 invested.

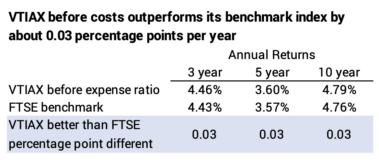

A difference is that the Vanguard funds do the best job of tracking their benchmark. I add back the 0.11% expense ratio to VTIAX. I find that before costs, the fund performs better than its benchmark. VTIAX, in essence, is the underlying fund for VXUS ETF.

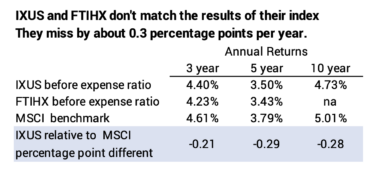

Blackrock and Fidelity don’t track their index nearly as well and underperform their index by about .3 percentage points in return per year.

Note: I picked VXUS for our portfolio in 2014. This was the first time I owned an international stock index fund. FTIHX formed two years later. Our portfolio is at Fidelity. My fee to buy VXUS was $5 as I recall ($0 now), and it was and is $75 to buy VTIAX – Vanguard funds are not part of Fidelity’s No Transaction Fee network. In 2017 I purchased some FTIHX (called FTIPX then): it’s easier for me to rebalance to my design mix of US vs. International stocks each December. I do a simple exchange between FSKAX and FTIHX, and I don’t have to sell FSKAX, wait until it settles, and then buy VXUS.

Conclusion: I find few – four – funds that are Total International Stock index funds aiming at the return for all traded International stocks in the world. Vanguard, before deduction of expense ratio, outperforms its benchmark index by about 0.03 percentage points per year: excellent. The two others, before cost, underperform their benchmark index by about .3 percentage points per year.

The dollar return difference over ten years between these funds is small. VXUS – Vanguard International Stock index ETF – had the highest returns over three, five, and ten years.