Why will Social Security (SS) increase by 3.2% when inflation was 3.7%?

Posted on October 13, 2023

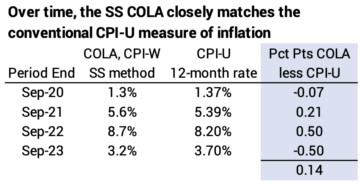

I’m sure you saw this news this week: SS benefits will increase by 3.2% for 2024. At the same time, the news was that 12-month inflation was 3.7%. Why the difference? This post is a refresher: SS uses a different measure of inflation than is commonly reported, and it calculates its Cost-of-Living Adjustment (COLA) differently. Over time, the SS COLA increases very closely match the more common measure of inflation. Adding up the last four years shows COLA to be a bit greater than the conventional way to look at inflation.

Detail:

== CPI-U and CPI-W ==

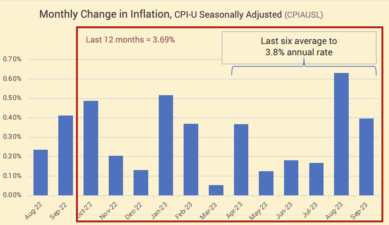

The inflation rate commonly reported is the past 12-month rate based on the measure CPI-U (Consumer Price Index for all Urban Consumers) or CPI-U Seasonally adjusted. Over 12 months, these two are essentially the same.

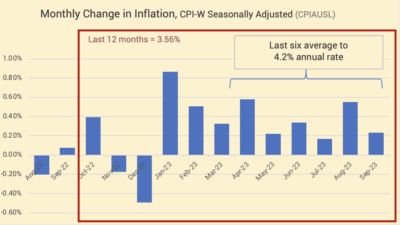

By law Social Security uses CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers). You find the data for the past ten years for each here. Data for a month is added roughly by the second Thursday of the following month.

CPI-U and CPI-W don’t exactly track each other. The 12-month rate ending September for CPI-U Seasonally adjusted was 3.69%. The 12-month rate for CPI-W was 3.56%.

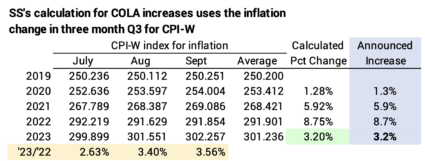

== The math for COLA ==

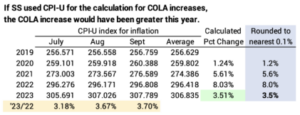

SS calculates the increase in COLA using the increase over the average of three months in Q3 of each year: July, August, and September. For this year, it averaged the index for those three months for 2023 and compared that to the average of those months for 2022. That average – 3.20% – is less than if it had used just the 12-months ending in September – 3.56% – because the 12-month rates for July and August were lower.

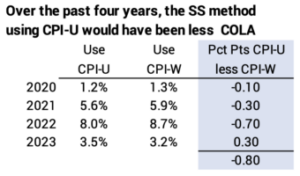

If SS had used CPI-U in its calculation, COLA would have been greater for this year but less in prior three years and for the past four years.

Conclusion: Social Security uses the average inflation increase over the three months in the third quarter in the calendar year to calculate the Cost-of-Living Adjustment (COLA) in benefits for the upcoming calendar year. This year, its measure of inflation, CPI-W, resulted in less COLA than the 12-month rate of inflation for the more commonly used CPI-U measure of inflation.

Over time, the COLA increases should be almost identical if it had used CPI-U; over the past four years, CPI-W has resulted in greater COLA than if the calculation used CPI-U.