Do institutional fund managers outperform mutual fund managers?

Posted on October 6, 2023

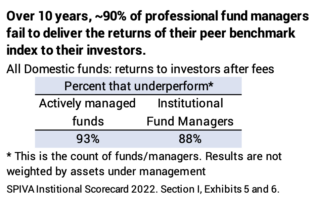

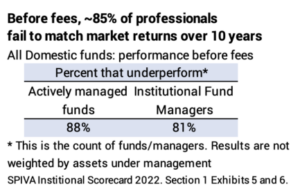

A SPIVA report that I summarize in this post shows that nearly 90% of institutional fund managers return less to the owners of their fund than their benchmark index over 10 years. I recently summarized a prior SPIVA report on active mutual fund managers: it showed that 15 of 16 underperform their peer index funds over 20 years. Combining the two, SPIVA data shows that ~90% of all professional, active fund managers return less to their shareholders than their benchmark index. This underperformance is not simply due to greater fees: before consideration of fees, SPIVA reports than roughly 85% of professional fund managers fail to match the returns of their peer benchmark index.

Details:

== Data on Performance ==

You and I invest in regulated mutual funds or Exchange Traded Funds (ETFs). Most ETFs track an index like the S&P 500 or a total market index. SPIVA has tracked the performance of actively managed funds as compared to their peer, benchmark indices for 20 years. The data for this comes from CRSP, which maintains a database of the performance data that all 8,700 regulated funds submit. The Investment Company Institute, the trade association for regulated mutual funds and ETFs, also relies on this data for its annual Factbook. I summarized the most recent SPIVA and ICI reports here.

Institutional investors are pension funds, insurance companies, university endowments, foundations, and others who hire fund managers to try to beat the market. The managers invest directly in stocks and build stock portfolios. They are not regulated by the same Acts as mutual funds as ETFs. They are not required to submit annual performance data. SPIVA uses self-reported data to show performance over ten years; it hasn’t reached the 20-year market for this data.

== Performance ==

The first chart above shows that, over ten years, 88% of institutional managers fail to return market returns to their investors over their peer index over ten years. That’s a bit better than the 93% of mutual fund managers who fail.

The second chart above shows the results before costs: SPIVA reports add back a fund’s expense ratio or manager fees. Before costs, 80% to 90% of active fund managers fail to beat their benchmark index fund.

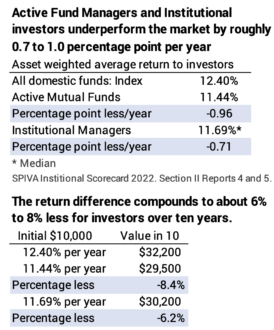

SPIVA reports than active fund and institutional managers return about about 0.7 to 1.0 percentage point lower than market returns. That difference cumulates over 10 years to about 6% to 8% less from active managers than from an index fund.

Conclusion: SPIVA is the best source of performance of active mutual fund and institutional managers. The results show that about 90% of these managers fail to match their benchmark index or index fund. They return about 0.70 to 1.0 percentage points lower return and over the last 10 years, the lower return rate compounded to 6% to 8% less than the benchmark index.