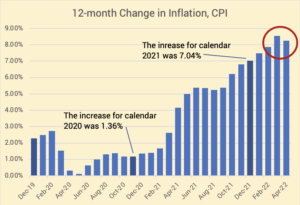

Does the start of the worst sequence of returns start exactly in January 1969?

FIRECalc builds many historical sequences of stock and bond returns in history and displays how a portfolio will fare over time for all the sequences. Nest Egg Care uses THE Most Harmful sequence as the baseline assumption for determining a Safe Spending Rate in retirement