What do we do now?

Posted on May 20, 2022

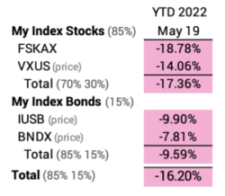

Oops. This is getting serious. My stocks are down more than 17% from the start of the year. My bonds are down more than 9%. (And the real declines are greater when I adjust for inflation.) Those are steep declines. Not nearly as steep for stocks as in 2020, but steep enough. At times like this, the emotional part of my brain shouts, “DO SOMETHING. YOU’VE GOT TO ACT TO CONTROL THIS.” The thinking part of my brain says, “Don’t panic. You can’t control the market. You can’t predict. It’s a long game. Stand pat as you have in all other declines in the past.” But there are a few things to consider than can win you a few bucks. This post mentions three actions. I acted on two this week. My thinking brain can say, “See. I did do something!”

== Consider taking part of your RMD now ==

Patti and I are both subject to RMD. I’ve described this before, but it makes sense to take your RMD when the market declines: assuming your investment rebounds, you are saving on taxes. It’s simplest and clearest to take your RMD now by transferring securities from your retirement account to your taxable account.

• Option #1. Let’s assume I take $10,000 of RMD now. I transfer shares of FSKAX worth $10,000 from my Traditional IRA to my taxable account. (When I transfer shares, I do not withhold taxes; I’ll withhold the proper amount for the year the first week of December when I sell added securities in our Traditional IRAs for at least the balance of our RMDs.)

Let’s assume the value of FSKAX rebounds +20% at some time in the future: that would be a gain of $2,000 from its present value. Assume I sell those shares no earlier than a year for our spending. I incur a capital gain tax of 15% on the $2,000 gain: $300. I get to keep $1,700 of the $2,000 for our spending.

• Option #2. I just keep the $10,000 in my Traditional IRA. It similarly rebounds by 20% or $2,000. Assume I sell and distribute it to my taxable account when I would have sold in Option #1. I pay 22% tax on that $2,000 gain: $440 in tax or $140 more that in Option #1. I get to keep $1,560 for our spending, roughly 8% less.

Summary: I likely will make $140 for each $10,000 of FSKAX transferred now from a Traditional IRA.

My action: I took about half my RMD this week by transferring shares of FSKAX to my taxable account.

== Consider converting from Traditional to Roth ==

You never lose when you convert from Traditional to Roth if the tax bracket when you convert is the same as when you spend from your Roth. You come out ahead if your marginal tax bracket is greater in the future or if you can use Roth to lower your AGI and avoid a Medicare Premium surcharge. The first AGI tripwire for married, filing jointly costs about $1,900.

In my tax planning, I will project our AGI and judge to see if it is close to the first first tripwire that could cost us $1,900. If I am, change the source of cash we’ll need for our spending: I’d sell securities from our Roth (no AGI) to lower our total AGI. Smart use of Roth could save $1,900 in Medicare Premiums, so that is a big potential savings. (This is a more obvious concern when it is just one of Patti or me who is alive; income for the survivor won’t change much, but the Medicare tripwire will be half of what it is for married, joint filers.)

If you don’t have enough in your Roth account, this is a good time to convert. You are getting more bang for your tax dollars if you convert when stocks have dipped. They rebound in your Roth account at no future tax consequence.

My action: I already converted enough in my Roth account. I’m pretty sure I can avoid Medicare tripwires in the future. I’m not converting more now.

== Buy an I-Bond: likely $500 more ==

My friend Jay pointed this out to me. This is a good video on I-bonds. You can buy an inflation protected bond that will earn more interest than you can from, say, money market or bank CD. Rates are variable and are stated every six months: May and October. You are limited to $10,000 per person per year. You must hold the I-bond for a year. You forego three months of interest when you redeem your bond unless you hold on to it for five years; I’ll never hold it that long.

The guaranteed annual rate for the six months May through October is 9.62% – 4.81% for the six months. I will earn $481 on my $10,000 invested before November 1. The rate that starts November 1 will be restated in October. I’ll earn that rate for the next six months. Assuming that rate will be lower, the annual rate may be more than 7%: $480 + more than $220 if the next rate is greater than 4.40%).

Even if I sold in one year and did not earn 3 months of interest, the interest for the year will exceed ~6% ($480 + $110 if the rate is greater than 4.40%). That handily beats my money market rate, currently at 0.25% annual rate; we hold no CDs; we earn 0.01% rate on our checking account. The math for us: forgo $25 to earn +$500 – more likely $700 – on the $10,000.

Patti and I easily have $10,000 in our checking account + money market at Fidelity at any point in time. The total peaks in December each year (That’s when I sell securities for all our spending for the upcoming year.) and it is lowest at the end of November. Owning an I-bond isn’t as flexible a money market. I have to plan on lowering our average cash + money market balance by $10,000.

You have to buy I-bonds direct from the US Treasury. Yesterday I opened an account at TreasuryDirect on this site. That took 10 or 15 minutes. This video is clear. My account is linked to our joint checking account. The BuyDirect tab on the site led me to the purchase of my $10,000 bond. I looked this morning and they debited from our checking account at midnight.

The $10,000 will accrue interest until I redeem the bond. I may redeem in one year, but I’m guessing I’ll likely hold it longer. I’d guess the next three-month rate will be attractive; I wouldn’t to forego 3 months of interest at a high interest rate, but, then again, the difference may only be $100 or so. I’ll sell three months after the newest six-month rate drops to what I judge as too low of rate.

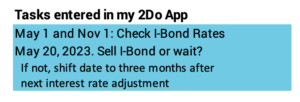

I have two administrative tasks to track that I entered into my 2do app: I need to check the six-month rate each May 1 and November 1. I need to decide on next May 20 if I should sell the bond.

Conclusion: Stocks and bonds are making me ill right now. The emotional part of my brains says, “DO SOMETHING.” The thinking part of my brains says, “HANG IN THERE. Don’t do anything crazy.” But it also knows and finds a few things to do that might make me a few $100 or even more than $500 per $10,000: 1) take a portion of RMD now; 2) convert from Traditional to Roth; 3) buy an I-bond. I did two of these three this week. My thinking brain can say to my emotional brain, “Pipe down. I am doing SOMETHING.”