Snapshot of returns this year do not point to a real increase in spending for 2019

Posted on October 5, 2018

In Nest Egg Care, Part 3, I recommend that you recalculate at least every three years to see if you can increase your Safe Spending Amount (SSA) for the upcoming year. Patti and I recalculate annually. Your recalculation always leads to a greater real amount if the real returns over the past 12-months are greater than the amount you withdrew last year. The purpose of this post is to give a snapshot of returns to date if you follow the investment advice in Nest Egg Care.

Here’s the example of how returns affect your annual Safe Spending Amount (SSA). At the end of last year, Patti and I withdrew 4.75% (our Safe Spending Rate or SSR%) from our Investment Portfolio. (See Part 1 and Chapter 7, Nest Egg Care.) Therefore, if the real return for 12 months is greater than 4.75%, we’ll be able to withdraw a real increase in our upcoming Safe Spending Amount.

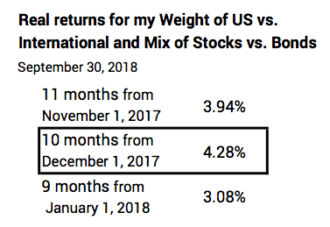

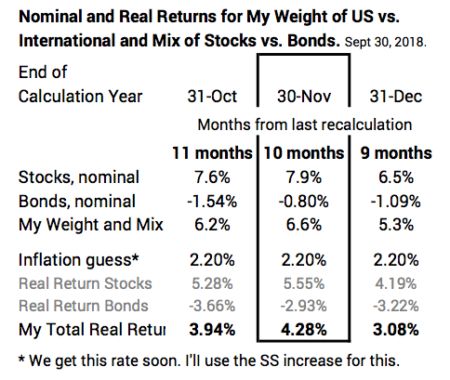

Since Patti and I use November 30 for our recalculation date, the proper picture for us as of September 30 is the 10-month return. Some folks I know use October 31, so they’d want to see the 11-month return. Others use December 31, so it’s a 9-month picture for them. Here are the total returns for the past 11 months; 10 months (outlined); and 9 months. I use the weights and mix that Patti and I use. (See Chapter 11.)

For Patti and me (10 months) the real return on our portfolio is 4.3%, and it’s a bit lower for other time periods. The basic conclusion is that we all are on track for positive returns for the year. But total return is not great enough for those of us with a greater SSR% to recalculate to a real increase in our SSA for 2019.

Your returns will vary from these depending on your weights and mix. And obviously the returns we will use for our recalculation will be affected by returns for the next few months. (This first week in October points to lower returns than these for our recalculation.)

Patti and I are okay with these returns and no real increase for the upcoming year. This year’s modest return follows two prior years that boosted our Safe Spending Amount by 20% from the amount at the start of our plan four years ago. (Our portfolio return was +32% over 2016 and 2017 – that’s the compounding of +11.3% (2016) and +19% (2017). All retirees with a nest egg are far better off now than they were then.

========

Here is a more detailed display.

For the 10-month period stock returns are about 5.6% real return; this compares to their long run average of about 7% annual return. US stocks are ahead of the game while International stocks are in negative territory. (Last year, International stocks returned more than US Stocks.)

Bonds are our insurance for when stocks tank. Real bond returns this year are under water – about -3%; their long run average is about +2.3% return.

Conclusion: Total portfolio returns are modestly positive for the periods leading up to the 12-month returns that we use when we recalculate to see if we can increase our Safe Spending Amount for the upcoming year. Returns to date tell us we all will stick with the same real SSA we used for our 2018 spending. Our dollar amount will simply adjust for inflation in the way Social Security payments adjust. That’s fine with Patti and me after the two years in a row that led to +20% increase in our SSA.