Our Safe Spending Amount will increase by 2.8% for 2019

Posted on October 23, 2018

Social Security always adjusts the amount of dollars it pays us so we closely maintain the same spending power over time. It announced last week that it will pay us retired folks 2.8% more dollars in 2019. And we Nest Eggers will also pay ourselves 2.8% more green pieces of paper in 2019: it looks like none of us will Recalculate this year and find we can take a greater than inflationary increase, unlike the result for all of us last year.

For Patti and me, that means our 2018 SSA of $54,000 – relative to an initial $1 million Investment Portfolio at the end of 2014 – will adjust to $55,500. We’ll use the same multiplier as in the past to get to our total SSA for 2019.

Let’s think Real for a minute or two:

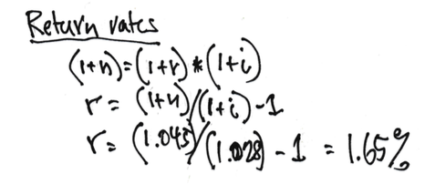

The 2.8% increase in inflation also means the real returns for stocks and bonds will be lower than the stated nominal returns that we all follow. For example, if the nominal returns for stocks wind up at 4.5% for a 12-month period (Right now it’s looking to be less than this.), the real return would be about 1.65%.

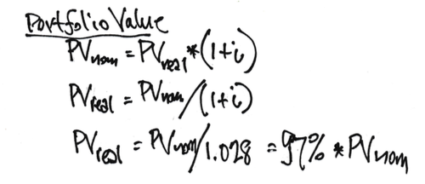

The 2.8% increase in inflation also means that the real spending power of our portfolio is about 3% less than the count of dollars we look at now.

When we all Recalculate (Patti and I recalculate just after November 30.), we’ll have a more accurate picture of returns and the real 12-month change in our portfolio value.

Conclusion: We’ll all have 2.8% more pieces of green paper with dollar signs on them to spend in 2019. Unfortunately, the spending power of our portfolio has shrunk by about 3% from inflation.