Can you Earn, Invest and Spend and NEVER pay tax? Yep: it’s an HSA account

Posted on April 26, 2019

A Health Savings Account (HSA) is about the best investment opportunity ever: it’s Triple-Tax Free. Nothing beats that. You likely accumulate +25% more after-tax dollars for spending from an HSA than from the next best thing, your retirement accounts. This post explains why – if eligible – one should try to fully contribute to an HSA. And why, for us retirees – most all of us not eligible for an HSA – this rises to very high on the list of money-gifts you may want to make to your children or grandchildren.

I used to say that you could never avoid paying income tax on the money you spend. You typically pay income tax when you earn it, and then you pay capital gains tax on the growth. Then you can spend it – and often pay sales tax on that.

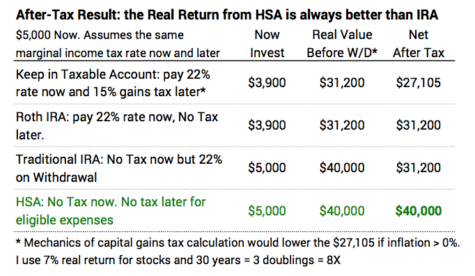

A retirement account is better: you pay tax one time – when you contribute or when you withdraw for spending, but the effect is the same for either a Roth IRA or Traditional IRA (and similar plans): you do not pay tax on the accumulated growth. The table above shows that the outcome for Roth and Traditional IRAs are the same. Read here if this is not clear to you – it’s not intuitively obvious that they are basically the same.

But a Health Savings Account (HSA) beats a retirement account: growth similarly is not taxed, but you pay NO TAX when you earn or when you withdraw for eligible spending. You accumulate more to spend with an HSA. (Read here on the 7% real return for stocks and here for the math for doublings that are mentioned in the note to the table above.)

== What’s an HSA? ==

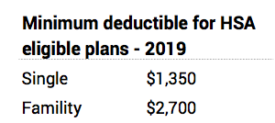

A Health Savings Account (HSA) is associated with an eligible High Deductible Health insurance Plan (HDHP). Unfortunately we retirees who receive Medicare aren’t eligible. But your children or grandchildren may have an HDHP and therefore are eligible for an HSA.

HSA-eligible plans have lower monthly premiums but high deductibles shown below for 2019. The employee pays the first medical bills up to the stated deductible. Then the health plan pays most or all costs thereafter. An employee will know if the plan they pick is HSA eligible.

A high deductible plan is more attractive to younger folks who believe they are healthy and won’t consistently be out of pocket for the deductible. Since monthly premiums are lower, they’ll pay a lot less over time if they don’t spend much of the deductible. I think Patti and I went decades with very few medical bills. I think I visited a doctor less than once a year on average up to age 45. I would have found a high deductible plan attractive, but my employer never offered one.

Many employers only offer a high deductible plan (HDHP) that is HSA-eligible to their employees. I was on the board of Propel Schools, and that’s what they offered to their employees. Propel contributed to an employee’s HSA that they sponsored – that’s not unusual – such that the annual cost to an employee would always be attractive relative to a plan with a lower deductible – the kind I was most familiar with.

== Triple NOT TAXED #1 ==

Contributions to an employer’s HSA – or to one that an employee opens independently – are NOT TAXED. The employee records the contribution as a deduction from other income. An employee can contribute $3,500 in 2019 ($7,000 Family Coverage). Contributions are not limited by higher income. (Contributions to Roth IRA are limited by higher income; the tax deduction for a contribution to a Traditional IRA is limited by higher income.)

== Triple NOT TAXED #2 ==

Growth of an investment in an HSA is NOT TAXED. This is the same as for a retirement account.

== Triple NOT TAXED #3 ==

Spending on eligible expenses is NOT TAXED. I look over the list and find that Patti and I have a significant amount of these expenses now. We’ve both had big dental expenses over the past five years, for example. I really would like to have had a triple tax-free account accumulating for the potential costs of long-term care.

== Never worse than a Traditional IRA ==

Over age 65 you can spend from an HSA for non-medical expenses – that vacation to Hawaii! – and pay tax just as if it was withdrawn from a Traditional IRA. Unlike a Traditional IRA, you are not required to make annual taxable withdrawals after age 70½. On death, what’s left in the HSA is treated like an inherited IRA.

== The investment benefit ==

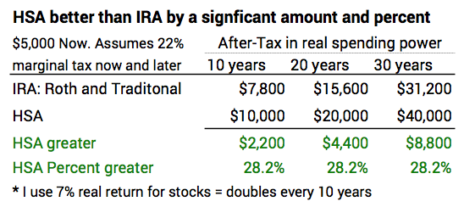

An HSA is always better than a retirement account when you spend for eligible expenses. The net after tax from a retirement account is always lower than the amount from an HSA by the marginal tax rate – either when you contribute (Roth IRA) or when you withdraw (Traditional IRA). At a 22% marginal rate, you’d have 22% less in an IRA; this equates to 28% more from an HSA. You can see the power of compounding of returns. Let the amount you put into an HSA compound for many years: you put in $5,000; you have $8,800 MORE in purchasing power in 30 years from an HSA than from, e.g., a Roth IRA.

== Zero Cost! ==

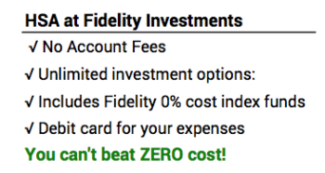

The landscape of independent HSAs (and maybe company sponsored HSAs) has changed. I remember high account fees and horrible investment options when I looked at HSAs years ago. A big change came when Fidelity entered the game of independent HSA accounts just last November. You can read an opinion on this plan. See here for more detail. Here’s my snapshot of what one gets with an HSA at Fidelity. You can’t beat this:

Conclusion. We older retirees aren’t eligible for a Health Savings Account (HSA). But your son, your daughter, or a grandchild now may have a High Deductible Health Plan (HDHP) that is HSA (Health Savings Account)-eligible. An HSA is the best investment account for the future: contributions, growth and withdrawals for eligible expenses are never taxed. Nothing beats this. We should urge our children and others in our family who have an HDHP to contribute. Your gift now to their HSA is about the best financial gift you can make. That’s a 28% better gift than eventually leaving the balance of your IRA to them.