Should my 40-year old niece contribute to a Target Date fund for her 401k?

Posted on August 14, 2020

My niece texted me last week. Her employer is being acquired, and her investment choices for the replacement 401k plan are completely different from those in her current plan. The plan identifies a default investment option, a Target Date fund offered by American Century. I’m pretty sure her default would be AROIX, the Target Date fund for 2045 (She’s 40.). (Target date funds are also called Lifecycle funds.) When you are many years from retirement, a Target date fund is invested in a greater mix of stocks. Over time the fund shifts to less stocks and reaches a final mix at the target date. My niece asked. “Is this a good choice for me?” This post gives my view on Target Date funds. I conclude that I don’t like them. Her plan offers options that are much better for her.

== What’s there not to like? ==

1. I don’t like the beginning mix of stocks and bonds.

My niece will rollover her current holdings into this 401k and add to it year after year. The first time she’ll withdraw – sell shares of this fund – is 25 years from now. That’s a holding period of 25 years on the current amount and additions this year. And she won’t sell all that’s there in 25 years; she’ll sell small increments each year – her annual Safe Spending Amount [See Nest Egg Care, (NEC) Chapter 2.]. That means some of the amount she has now will be around for another 20 years or so to 2065.

You could look at the stack of money she’ll have at the end of 2020 this way: some part has a holding period of 45 years! And another part has a holding period of 44 years. And so on down to 25 years. Those are loooong holding periods.

The fact sheet for AROIX shows its current mix is 74% stocks and 26% bonds + money market. My niece HAS TO BE 100% STOCKS for the shortest holding period of 25 years. She’d never choose to invest in bonds or cash for a 25-year holding period. Three reasons: 1) stocks are far greater in expected return rate; 2) over that many years the average annual return rate for stocks is more predictable than bonds; 3) the chance is near 100% that stocks will outperform bonds – and by a wide margin.

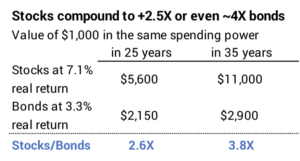

• Stock returns are about 2.3X that of bonds: the real return for stocks is 7.1% per year, and it’s 3.1% for bonds. 7.1/3.1 = 2.3X. Over 25 years at expected return rates, she’ll have three times as much from stocks as bonds. Over 35 years, the difference stretches to 5X.

• Stock returns are more predictable than bond returns for long holding periods. Math whizzes measure the variability of annual returns over different holding periods. (The measure is called Standard Deviation.) When they do that math on actual, historical return sequences, we find that stocks are less variable – more predictable – in annual return rate than bonds for all holding periods longer than 17 years.

• Statistics aside, bonds have outperformed stocks for a rare few 25-year holding periods over the very long history of accurate stock and bond returns. Those are times when bond returns have been unusually good while stock returns have been unusually bad. This happened because of one 20 or so-year stretch when bond returns were the best they have ever been. A stretch like that can’t be duplicated from today’s starting point.

Bond prices move in the opposite direction of interest rates. The more interest rates fall, the greater the increase in bond prices and total return. As an example, mortgage interest rates fell from 17% in 1982 to 5% in the early 2000s. That decline meant bond prices and total returns soared to result in about 7% real annual return for the next 20 years or so – far greater than their long-term average. We’re at less than 3% mortgage rates today. Interest rates can’t fall far enough for bond prices and returns to soar to match or exceed returns for stocks over that many years.

2. I can’t stand the ending mix of stocks and bonds.

The ending mix for AROIX is similar to other Target Date funds I find: 40% stocks and 60% bonds. You see this by selecting “GLIDEPATH” under Composition on that same page for AROIX. I shudder at the thought of retirees having a mix of 60% stocks and 40% bonds, and AROIX doesn’t even get close to this. My niece should NOT be entering retirement with that horrible mix of stocks and bonds.

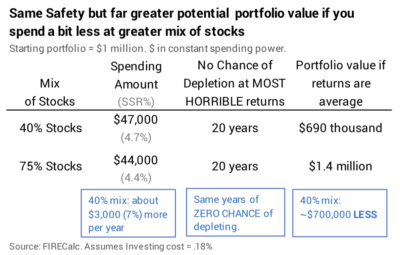

Here’s the problem: we work back on what’s the proper mix of stocks and bonds at the start of her retirement – when she first starts to withdraw from her retirement plan. I run through this discussion in Chapter 8, NEC, and conclude there is little to justify less than 75% stocks. But I run two cases in FIRECalc and summarize them here:

Let’s assume you want 20 years of ZERO CHANCE of depleting your portfolio assuming the MOST HORRIBLE sequence of financial returns in history.

A mix of just 40% stocks buys you about $3,000 more per year of Safe Spending Rate (SSR%) than a mix of 75% stocks. That’s about 7% better.

But the cost – or tradeoff for that $3,000 more per year – is $700,000 in potential portfolio value if the return sequence you face is an average one. Would anyone really take $3,000 more per year with the expected result of having $700,000 less in 20 years?

This added $700,000 really means that my niece – at 75% mix of stocks – will Recalculate (Chapter 9, NEC) to FAR GREATER annual Safe Spending Amount (SSA) over time than if she was at 40% mix of stocks. How much more per year depends on how frequently she recalculates her SSA. But the ROUGH translation of that $700,000 works out to average $35,000 more per year in real spending power over 20 years – her approximate life expectancy at age 65 – than the starting $44,000: that’s the added $700,000 divided by 20 years.

Solution: just spend a few bucks less per year and use a mix of 75% to 85% stocks. You get the same safety – the same number of years of ZERO CHANCE of depleting your portfolio, but MUCH GREATER potential growth in your portfolio. Much greater growth translates to more to spend in retirement and/or much more in the future. That should be a very easy decision.

3. I hate the expense ratio.

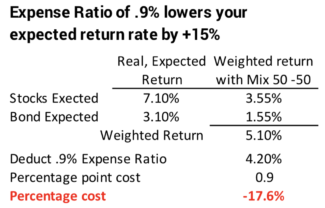

The expense ratio for AROIX is .89%. WAY, WAY TOO HIGH. Over the 25 years to 2045, I’d estimate that the fund averages 50% stocks and 50% bonds. That means the expected return before costs is about 4.7% real return. The .9% is eating nearly 20% of the return potential and growth over time. THIS IS CRAZY. This fund combines low mix of stocks and high investing cost. DON’T GO THERE.

== Better choices ==

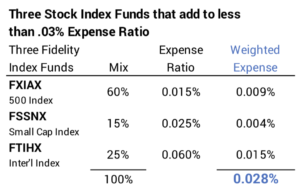

The plan had many other choices. A few were low-cost index funds. I recommended 100% stock and three index funds: the first two add to my attempt for the US total market. Her total investing cost is about .03% per year or 1/30th that of AROIX.

Conclusion: My niece asked if the default choice for her 401k – a Target Date fund – was a good pick. I do not like this choice AT ALL: too low mix of stocks now; too low mix of stocks on the target date; WAY, WAY too high of expense ratio that likely will consume 20% of growth over time. She had a far better choice of three index funds that cover US and International stocks. Her combined expense ratio is 1/30th of the default; she won’t be giving up that 20% of growth.