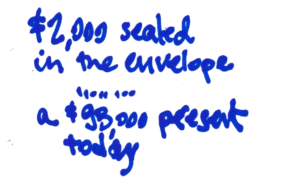

How much was in the envelope that I opened this past January 1?

Posted on February 11, 2022

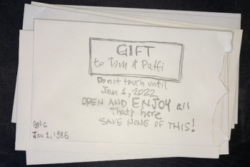

I imagine on the morning of each January 1 that Patti and I open a gift envelope from the much younger Tom to the older Tom and Patti. I imagine we open the gift envelope that held the $2,000 that I contributed to my Traditional IRA 36 years ago. It sat there invested in the same security for all those years. This year’s envelope had $98,500 for us to spend and enjoy. This growth, 49 times my investment, is not unusual over that period for someone who followed very simple investing rules. The purpose of this post is to reconfirm the rules for those in the save and invest phase of life (Tell your children! Tell your grandchildren!): save and invest; hold only stocks for long holding periods; you will do VERY WELL by investing in a general stock index fund.

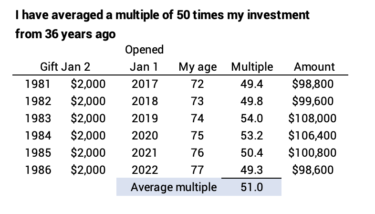

== Six envelopes: all about 50X ==

I’ve written about our gift envelope each of the last several years. This is the sixth envelope like this that I’ve opened. 1981 was the first time all workers could contribute pre-tax to an IRA. Prior to that only workers without an employer pension plan could contribute pre-tax. Pre-tax was a big incentive to contribute: my contribution was treated as a deduction from income on our tax return, and tax rates were high then. I was compulsive about contributing and made sure my contribution was invested on January 2 of each year. (That means I mailed my $2,000 in December to arrive the first business day of the new year so that it would be invested that day.)

I invested $2,000 in the equivalent of the obvious stock index fund at the time, VFIAX – Vanguard’s 500 Index fund. (I actually did better than VFIAX, but let’s ignore that for this story.) The envelope was sealed. I didn’t touch it.

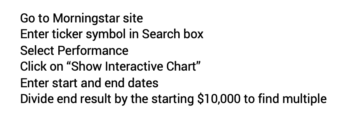

It’s straightforward to find how much my investment has grown over the decades. I use the interactive chart of performance on the Morningstar site. I input the start date and end date, and the chart shows me the multiple I earned on my investment.

The amount I was eligible to contribute did not inflation-adjust for a number of years. (The contribution limit has been adjusted to $6,000 now; an added $1,000 for those over age 50.) So far since 1981 I’ve had six contributions of $2,000. I’ve averaged about 50 times my initial $2,000 for these six.

== Real Growth about 20X ==

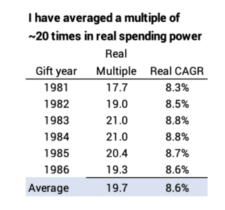

I need to inflation-adjust to get a more accurate story of what happened in terms of real spending power. I have averaged about 20 times growth in spending power for each 36-year holding period.

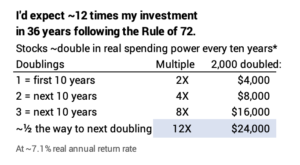

Using the long-run average annual return rate for stocks of about 7.1%, the Rule of 72 tells me I would have expected my $2,000 to have doubled in spending power every ten years. 35 years is 3½ doublings. I would have expected $2,000 to grow 12 times in real spending power, not 20 times.

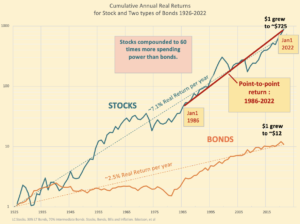

I’ve averaged 8.6% real return for these last six envelopes. The plot of real cumulative returns plotted on a semi-log graph shows why. My six point-to-point rides have started from below the long-term trend line and ended at or above the line. The steeper the slope of a point-to-point line, the greater the return rate. That 1.5 percentage point difference in annual return resulted in a lot more spending power.

== Stocks earned 4.6 times more than bonds ==

The point-to-point slope for bonds also has also been steeper than its long-term trend line. The inflation-adjusted multiple for bonds was 4.2 for this period 1986-2022. The 19.3 multiple for stocks was 4.6 times that of bonds. I had 4.6 times more money from stocks than if I had invested in bonds.

== Tolerance to ignore the bad ==

I always thought that my gift was in a sealed envelope. I did not think it was proper to open it beforehand: I never opened Christmas presents I saw under the tree ahead of time.

What did I ignore over the years? I ignored: the steepest one-day decline in stocks in history (23% in 1987); the second-worst three-year decline for stocks in history (-42% over 2000-01-02); the second-worst one-year decline (-34% in 2008); the worst nine-year return period for stocks (-42% cumulative return 2000-2009); the third longest stretch of zero cumulative real return for stocks (13 years 2000-2013). Ah, the ability to translate the knowledge that it’s a looong game into inaction.

Conclusion: At the end of every year, I look back to see how well we did from our save and invest phase of life. I consistently contributed to my Traditional IRA for many years. I held the same security for decades, I can go back and see how my contributions have fared. Every January 1, I calculate what happened to the contribution that I made to my Traditional IRA 36 years ago. Pre-tax contributions began in 1981. This January 1 was my sixth look back. My $2,000 invested 36 years ago grew to more than $98,000 – growth greater than 49 times. This is the same as anyone would have earned had they followed very simple investment advice: only invest in stocks for long holding periods; invest in a general stock index fund. You will do Very Well over time.