How bad were bond returns in the last two years?

Posted on February 17, 2023

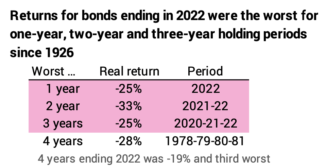

I briefly mentioned in this post that the -25% real return for bonds for 2022 was the worst in history and the past two years have also been the worst in since 1926. I provide more detail and perspective in this post as to how badly bonds have performed in recent years: we can add that the three-year return ending 2022 was the worst since 1926; with the exception of 2021 and 2022, bonds have been good insurance when stocks have declined: bonds have almost always outperformed stocks when they declined. 2022 was the big exception.

== Absolute Returns ==

The periods ending in 2022 were the worst one-year, two-year, and three-year return for bonds since 1926. I’m use the data that generated the graph of real returns for stocks and bonds since 1926 that I included in the January 27 post.

== Relative returns: one year ==

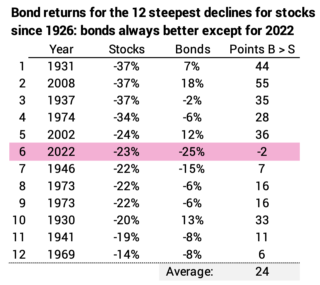

We hold bonds as insurance. We use our insurance – sell it only or disproportionately – for our spending when stocks decline. When stocks decline, bonds normally outperform stocks. When we sell bonds, we deplete less of our portfolio. We give stocks more time to recover.

Bonds have really shined when stocks are at their worst. But not 2022. I show the worst 12 years for stocks and bond returns. On average, bonds have outperformed by 24 percentage points, but bonds were worse by 2 percentage points in 2022. That’s 26 percentage points off the historical average.

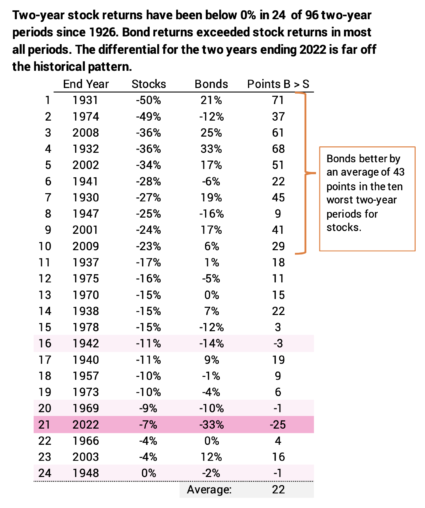

== Relative returns: two years ==

Stocks have declined in 24 of the 96 two-year periods since 1926. Bonds have returned more than stocks in 22 of those periods. Bonds were better than stocks by 43 percentage points in the worst ten two-year period for stocks. The two-year return for bonds for the period ending 2022 is far off the expected pattern.

== So? ==

Hey, it’s over and done. I’m still viewing bonds as insurance. I want to sell them, not stocks, when stocks have cratered: I want to buy time for stocks to recover, and I think stocks will do much better than bonds in the future. I’m doing exactly that for our spending in 2023: selling solely bonds.

I started our plan with what some would consider as a high mix of stocks: 85% vs. 15% for bonds. I’m happy that I did since bonds have not been had the insurance value than most anyone would have predicted.

Conclusion: This was a very poor year for bonds. This post gave some detail as to how poor. The year ending 2022 was the worst year for bonds since 1926; the worst two-year period; and the worst three-year period. Before 2022, bonds have always been better in return in the worst years of stock returns. Before 2022, bonds have averaged 22 percentage points than stocks for all the two-year periods when stocks returns were below 0%, but bonds were 25 percentage points worse in 2022.