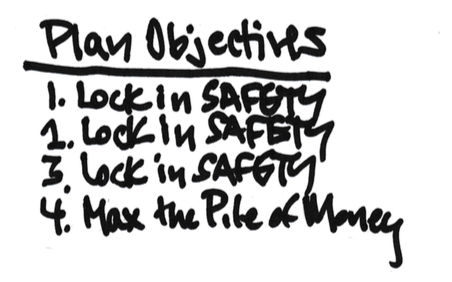

Once you’ve LOCKED IN SAFETY, Maximize the Pile of Money

The last post shows that you LOCK IN SAFETY – the number of years you want with no chance of depleting a portfolio – with three key decisions: Spending Rate, Investing Cost, and Mix of stocks vs. bonds. Different decisions on those three can lead