Tom’s Blog

How well do Active funds perform (Version 2)?

I read this article last week, Charts change hearts and minds better than words do. People understand better (and might think differently than they have in the past) by looking at graphs rather than by reading text and numbers in a table.

So,

Two really good $100 purchases on our vacation in England

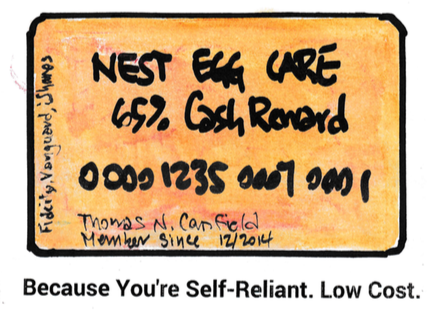

A few years ago, I found I was very grumpy and sometimes a bit frustrated with spending money that we just did not NEED to spend. I’m much less concerned – actually totally unconcerned about $100 expenditures – now that I understand our annual Safe