Tom’s Blog

What are the chances Index funds will outperform Active funds?

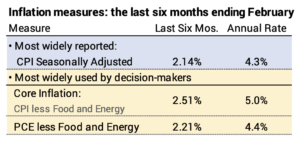

Last week I realized I had not read a recent SPIVA® scorecard report that compares the performance of Active funds to their benchmark index. My prior post on a detailed report was in 2018. I was not looking forward to reading the latest report because

What are the costs of holding Active funds?

I liked this article, “Index Funds’ True Advantages.” The author took a sample of 15 Index Funds and 15 low-cost Active funds and compared them over 15 years. While this is a very small sample – much smaller than the universe of funds examined